Apollo shares continue to fall on second day

Investors worried about debt-funding of $2.5-bn acquisition of Cooper Tire & Rubber

BS Reporter New Delhi Shares of Apollo Tyres declined for a second day on Friday as investors continued to express concern over the debt the company plans to raise to fund its $2.5-billion acquisition of US-based Cooper Tire & Rubber.

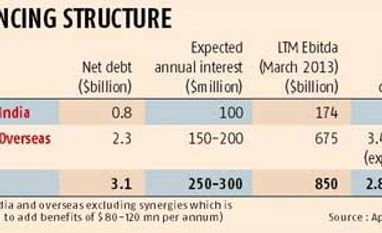

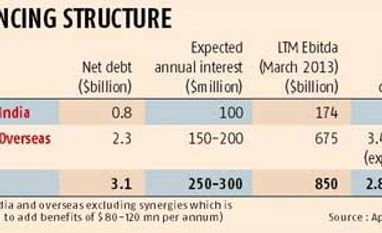

Attempting to assuage investor confidence, Vice-chairman and Managing Director Neeraj Kanwar clarified only about $450 million of the total $2.5-billion debt will be serviced by its India business, while the rest would be addressed by the cash flows of Cooper Tire and Apollo Vredestein BV.

Kanwar said, “The proceeds of around $40-50 million from sale of Dunlop South Africa would reduce the debt on India’s books to around $400 million. Possible dividend from overseas arms could also be used to service debt in India.” According to the financing plans outlined by the company, as much as 85 per cent of the debt of $2.5 billion would have exposure to Apollo’s foreign arms in the US (after the acquisition) and Europe. While $1.9 billion would be raised through bond issues largely in the US market, another $200 million will be brought in via asset-based lending. Apollo Tyres does not have any plans to convert the Cooper deal debt into equity immediately.

An additional debt of $400 million on books of Cooper Tire will also get rolled over to Apollo. “The debt loads are manageable both in India and overseas, which can be met from cash flows. The banks have fully underwritten the amount. The interest coverage for both entities are comfortable. There is hardly any risk. The diversified nature of the business would help insulate the company from any one geography,” Kanwar added.

Apollo Tyres, which currently does not operate in the US, gets two-thirds of its revenue from India, where a weak economy has hurt demand for cars and commercial vehicles. The acquisition of Cooper, the world’s 11th largest tyre company by sales, would give it access to the US market for replacement tyres for cars and light and medium trucks. The deal would also give Apollo brands access to the market in China, the largest in the world for commercial vehicles.

After the completion of the acquisition, Apollo would have footprint across four continents with 14 manufacturing facilities globally. Production levels would jump to 3,500 tonnes a day from 1,500 tonnes currently.

The proportion of India in overall revenues will come down to 22 per cent from 65 per cent. While China will contribute around 18 per cent to total revenues, the contribution from Europe would be around 12 per cent.

The US would pitch in about 43 per cent. Kanwar said, “We estimate that Apollo will gain approximately 55 per cent of revenues from high-margin western markets and around 45 per cent from high-growth emerging markets, which would enhance our geographical mix.”

The estimated cost synergy opportunities after the acquisition is projected to be $80-120 million a year at the earnings before interest, taxes, depreciation, and amortisation (Ebitda) level, the company said.

Apollo Tyres’ shares were trading Rs 64.90, down by 5.39 per cent on close at the Bombay Stock Exchange. The share price had declined by 25 per cent on Thursday.

)

)