Karnataka: Low incidence, limited fire power

However, the state's CID has set up cyber forensic laboratories and a cyber crime police station, the first of its kind in India

Mahesh Kulkarni Bangalore In Karnataka, the share of economic offences in overall crimes registered every year is very low, primarily due to the fact that the state police has taken a number of initiatives to address these cases.

About four decades ago, the Karnataka government had set up the Criminal Investigation Department (CID) to handle various cases, including economic offences. To deal with economic offences, the state police department has set up a separate cell within CID. This cell is headed by an officer of the rank of additional director-general of police. “The incidence of economic offences isn’t very high in Karnataka. We do not have very high capabilities to handle large economic offences. However, we have created a separate cell to deal with such cases and take the help of experts, when required, to handle complex cases such as financial frauds,” said P K Garg, additional director-general of police, economic offences wing.

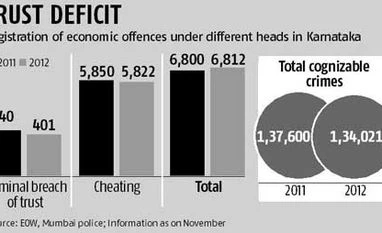

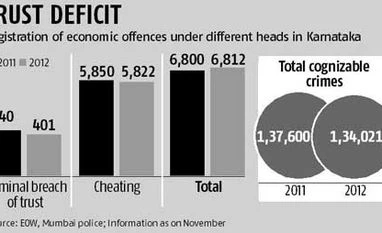

According to Crime Records Bureau, Bangalore, economic offences accounted for 5.08 per cent of all cognisable offences registered under the Indian Penal Code in Karnataka during 2012. The economic offences wing under the Karnataka Police CID registered 6,812 cases in 2012, against 6,800 cases in 2011.

So far, the state police department’s CID has resolved several cases and convicted about 50 persons. A high-profile economic offence detected and investigated by the department was that involving Srinivas Shastry, who had allegedly cheated the public of about Rs 10 crore through deposits in his financial firm Viniv Inc. CID has filed 14 charge sheets in this case, which is pending in a sessions court.

“Unless some serious economic offences are reported, we will not know what type of facility or preparedness is required in the department. However, we have more than 150 officers and constables trained to deal with such cases. The department has been booking a large number of cases involving commercial tax misuse cases, piracy cases, bank frauds and misappropriation cases,” Garg said.

The department has been constantly improving and equipping itself with latest technology and software required to handle economic crimes. As part of such efforts, it has set up cyber forensic laboratories and a cyber crime police station, the first of its kind in India. Recently, the state government sanctioned six additional cyber crime police stations, to be set up at six different range offices.

Aided by Nasscom, CID has set up a cyber training institute for its officers in Bangalore. Nasscom has provided the software, equipment and manpower to train police officials.

Recently, the state government sanctioned four financial intelligence units across the state. These units will collect information on people and companies engaged in various financial services. “Prevention is better than cure. We have posted some of our officers in these units, and they will collect information and prepare files on those engaged in different activities. As and when any financial fraud takes place, it will be easy for us to track such persons,” said a senior official in the economic offences wing.

CID has also proposed setting up an exclusive sessions court for cases filed and investigated by it. The proposal is in the final stages of being approved by the state government.

)

)