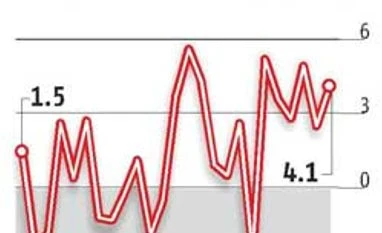

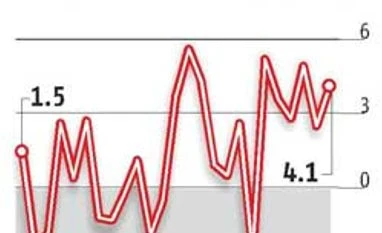

In what could be seen as good news for the government’s ‘Make in India’ programme and a good start to financial year 2015-16, the country’s industrial output grew 4.1 per cent in April, compared with 2.5 per cent in March.The recovery was mainly on account of a surge in the manufacturing sector, according to data released on Friday by the ministry of statistics and programme implementation (Mospi).

The data pleasantly surprised economists but growth was largely restricted to capital goods.

In April, the rate of manufacturing growth rose to 5.1 per cent, against the previous month’s 2.8 per cent (revised upwards from earlier quick estimates of 2.1 per cent). That growth was not broad-based could be gauged from the fact that mining rose 0.6 per cent in April, against 1.1 per cent in March, while electricity generation declined 0.5 per cent, compared to growth of 1.9 per cent. Power outage is described as a hurdle by many in the Purchasing Managers’ Index (PMI) survey.

Of the total expansion of 4.1 per cent, 3.85 percentage points were accounted for by the manufacturing sector alone. Manufacturing growth zoomed due to a surge in capital goods production to 11.1 per cent, compared with 8.6 per cent in March.

“This is a positive shock for all. There has been some pick-up in consumption. There have been some projects that have gone on stream. Manufacturing growth needs to be maintained. We should not forget that the manufacturing sector has been quite volatile in the past, so we need to wait and watch,” said Madan Sabnavis, chief economist, CARE Ratings.

While the capital sector is a volatile segment in the Index of Industrial Production (IIP) and its reliability to sustain industrial growth is not certain, the capital goods segment has been posting a growth rate between six per cent and 12 per cent since November. Economists attribute this to some stuck projects coming on stream. According to a project-monitoring group, set up to expedite clearance of held-up projects, all issues in 255 projects, worth Rs 9 lakh crore, have been resolved so far.

Sabnavis also attributed the sudden surge to an increase in the government’s spending in infrastructure projects, and an increase in investments which might have contributed to growth seen by capital goods.

The growth rate was not much high in other segments but consumer durables came out of the contraction mode. The segment grew moderately, by 1.3 per cent in April, against a contraction of 4.8 per cent in March and 7.7 per cent in April last year. However, tractor production continued to decline, amid rural distress. This contraction led to a fall of 20 basis points in IIP, according to data.

The output of non-durables part of consumer goods rose 4.4 per cent in April, against 2.4 per cent the previous month.

Basic goods grew 2.8 per cent and intermediate goods 3.3 per cent, against 2.5 per cent and 2.9 per cent, respectively, a month earlier. Industrial growth in April belied the straight inference from core sector data. The eight key infrastructure industries, with a weight of almost 38 per cent on IIP, had contracted for a second straight month in April, by 0.4 per cent, the most in 18 months.

However, surge in capital goods, not captured by the core sector data, turned saviour for industrial data. Besides, a rise of over 100 per cent in excise duty collections in April gave a slight indication to high IIP numbers, even as part of the increase came from an increase in excise duty on oil and resumption of duties on the automobile industry.

The industry group machinery & equipment showed the highest rate, of 20.6 per cent, followed by wood & wooden products (16.2 per cent), the data indicated. According to Aditi Nayar, senior economist, ICRA, the IIP numbers in April came as a “positive surprise” — much higher than expectations, and showing an upward revision over the March figures.

“The surprising uptick in IIP growth in April benefits from a healthy expansion in capital and consumer goods. The expansion in consumer durables is particularly encouraging, as it comes after 10 straight months of contraction, though the pace of growth is admittedly low at 1.3 per cent,” she added.

The industry group comprising office, accounting and computing machinery saw the biggest contraction in April. It fell 36.5 per cent, and was closely followed by radio and television sets (decline of 34 per cent) and tobacco products (down 26.7 per cent).

OUTLOOK - In May, Manufacturing PMI grew to a four-month high of 52.6 points

- Indirect tax collection jumped 37.3% (y-o-y) in May

)

)