Bank stocks crash on RBI move

Downside limited, say experts

BS Reporter Mumbai Banking stocks corrected an average of four per cent on the back of liquidity tightening by the Reserve Bank of India, under-performing the broader market on Wednesday.

Valuations may now be attractive enough to act as an entry opportunity for investors building a long-term portfolio though short-term volatility cannot be ruled out, suggest experts.

J Venkatesan, fund manager-equity at Sundaram Asset Management Co, said while short-term risks remained, the fall was based on sentiment. “It’s very clear that the sell-off in wholesale funded banks is panic-selling. We still like banks from a medium to long-term perspective. We like private sector banks for growth and the public sector banks from the perspective of valuations,” he said.

Wholesale funded banks refer to banks that depend on raising money by issuing debt instruments rather than through savings or current accounts maintained by their customers. The cost of funding for such banks rises with tightening liquidity conditions.

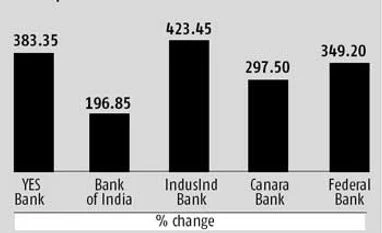

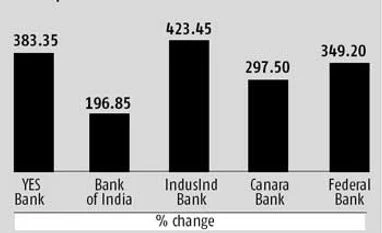

YES Bank was the top loser among the banking pack on Wednesday, falling 12.63 per cent.

R Murali Krishnan, head-institutional equities at Karvy Stock Broking, pointed out dividend yields on banks were climbing higher. “The downside looks limited with the way that the stocks have been beaten down. The dividend yield on these banks is between five to seven per cent.

One could look at the large-cap private sector banks or some of the bigger public sector ones,” he said. “RBI is worried about currency and further tightening of liquidity cannot be ruled out,” added Krishnan. However, he felt there was little room for much correction.

All 45 listed banks fell more than the Sensex on Wednesday, down between 1.51 per cent to 12.63 per cent, compared to the 1.04 per cent decline of the Sensex. Seventeen of these stocks ended with losses of five per cent or more.

In addition to YES Bank; Bank of India, IndusInd Bank and Canara Bank fell in excess of eight per cent. The index tracking banking stocks was down 4.61 per cent. Currency will be among the factors that would affect how bank stocks will move, according to Venkatesan. “One will watch to see if the rupee is stabilising as well as keep an eye on deposit growth and credit growth.”

)

)