Fund Pick: Birla Sun Life Short Term Fund

Getting the duration calls right

Crisil ResearchBirla Sun Life Short Term Fund, launched on March 3, 1997, has been ranked in the top 30 percentile (CRISIL Fund Rank 1 or 2) for the last four consecutive quarters. The scheme invests in diversified portfolio of debt and money market instruments of short- to medium-term maturity, which can offer superior levels of yields, at relatively lower levels of risk. Managed by Prasad Dhonde, the fund’s quarterly average assets under management stood at Rs 7,874 crore as on September 30, 2015.

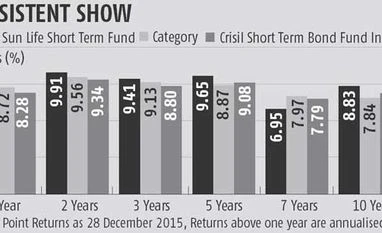

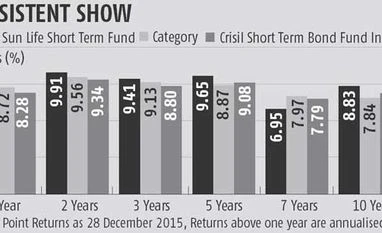

The fund has recorded a compounded annual growth rate (CAGR) of 9.53 per cent, since inception. It has consistently outperformed its benchmark (CRISIL Short-Term Bond Fund Index) and the category (represented by the Debt Short Funds under CRISIL Mutual Fund Ranking), across all time frames (see chart), the exception being the seven-year period.

Rs 1,000 invested in this fund from April 1, 2002 (inception date of the stated benchmark) would have grown to around Rs 2,936 (compounded annualised return of 8.15 per cent) as on December 28, 2015. A similar investment in the category and benchmark would have grown to around Rs 2,758 (7.66 per cent) and Rs 2,579 (7.13 per cent), respectively.

A monthly systematic investment plan (SIP) of Rs 1,000 over 10 years (on a principal of Rs 1,20,000) would grow to around Rs 1.90 lakh, delivering an annualised return of 8.92 per cent. A similar investment in the benchmark would have grown to around Rs 1.84 lakh (8.31 per cent).

The fund has carefully managed the interest rate risk, by altering the modified duration, as per interest rate movements. For instance, when 10-year G-sec yields rose from 8.34 per cent to 8.96 per cent between November 2012 and September- 2013, the fund reduced its modified duration from 1.36 to 1.05 years.

Subsequently, in a falling interest rate scenario, the fund increased its modified duration. For example, when the benchmark yield fell from 8.45 per cent to 7.54 per cent during October 2014 to September 2015, the fund increased its modified duration from 1.51 to 1.9 years.

On an average, over the last three years, the fund had the highest exposure to non-convertible debentures (NCDs) and bonds (63 per cent), followed by government securities (14 per cent). During this period, exposure to government securities gradually rose from 8.5 per cent to 32.25 per cent, with subsequent decrement in exposure to NCDs and bonds.

The portfolio is well-guarded in terms of credit risk, given the investments in the highest-rated debt papers (‘AAA/P1+’) and government securities. During the last three years, 91 per cent of the debt portfolio has been invested in these papers.

)

)