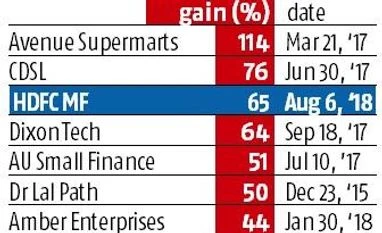

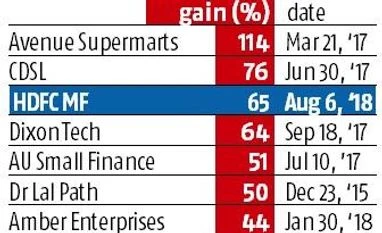

Shares of HDFC Mutual Fund surged 68 per cent during their trading debut on Monday, in what was the best listing-day performance since Avenue Supermarts last year for an IPO of more than Rs 10 billion. Shares of the asset manager ended at Rs 1,815, up Rs 715 or 65 per cent, over the issue price of Rs 1,100 per share. Avenue Supermarts’ shares had more than doubled on their trading debut in March 2017. The stock of the D-Mart retail chain operator is currently up 5.5 times over their issue price.

HDFC MF’s stellar debut follows huge demand for its shares in the initial public offering (IPO), which closed last month. The issue was subscribed over 80 times, generating bids worth Rs 1.7 trillion — the second most for a domestic IPO since Coal India’s offering in 2010. The issue garnered a record 24 million retail applications, with only one out of four applicants getting allotment.

Market players said institutional investors, who did not get enough allotment, were willing to pay a huge premium to buy the shares of HDFC MF in the secondary market. Shares worth over Rs 40 billion changed hands on the National Stock Exchange (NSE) and the BSE, where the stock hit a low of Rs 1,726 and a high of Rs 1,844.

Many investors see HDFC MF as the best play on financialisation of savings. Nomura in a report said it has a bullish view on domestic asset management companies (AMCs), given the strong growth opportunity. The brokerage expects structural tailwinds to outweigh cyclical headwinds and sees the industry post a 20 per cent annual growth in assets under management (AUM) till 2024-25 “with improving equity mix, as the sector is one of the key beneficiaries of the rising financial savings mix, while penetration levels are still extremely low.”

Currently, HDFC MF and Reliance Nippon MF are the only pure-play listed MF companies in the country.

HDFC MF, with AUM of Rs 3.1 trillion, is valued at Rs 388 billion. The listing day saw HDFC MF add Rs 152 billion in market value as it was valued at Rs 233 billion at the price.

Industry players said the premium commanded by HDFC MF is due to the HDFC brand name, a higher share of equity assets and a high number of retail investors. Managing equity assets is more profitable and sticky than managing debt assets. Among the large players, HDFC MF has the most favourable debt-equity mix and was also the most profitable fund house in 2017-18.

)

)