Sensex gets Budget blues, sheds 320 points

Nervousness around budget announcements, global weakness weigh on investor sentiment

BS Reporter Mumbai BSE Sensex fell over 300 points for a second day on Wednesday, weighed by weakness in the global market and nervousness surrounding the coming Budget.

The 30-share index shed 321 points, or 1.4 per cent, to close at 23,089, just 137 points shy of a new 21-month low. NSE (National Stock Exchange) Nifty lost 91 points, or 1.3 per cent, to end at 7,018.7.

The expiry of February series derivatives contracts on Thursday and investors' cautious stance hit market performance, said players. Most global markets, especially European, saw sharp cuts following a drop in oil prices, which raised fresh concerns over global economic growth.

With just two trading sessions before the Budget, investors have turned nervous whether the government will be able to deliver growth and focus on consolidation at the same time.

"Staying on the fiscal consolidation road map will not be easy for the government. It will have to do a tightrope walk of doling out wage and pension hikes, stepping up capital expenditure, and reducing fiscal deficit. While difficult, the task is not impossible," said domestic brokerage ICICI Securities.

Foreign investors continued selling, pulling out Rs 731 crore from stocks on Wednesday, provisional data showed. Domestic investors were net buyers of Rs 606 crore.

"Markets fell sharply, mirroring the weakness in global markets. With the Budget a few days away, markets will look out for measures to support growth and also for achievable assumptions on the potential sources of revenues. There are concerns regarding potential Budget announcements on taxability of long-term capital gains on shares," said Dipen Shah, senior vice-president and head of private client group research at Kotak Securities.

The fall on Wednesday was less severe than the one on Tuesday. Thirty six of the 50 components of the Nifty ended with losses. The mid- and small-cap indices fared better than the benchmark index, losing 0.8 and 1.15 per cent, respectively.

Among sectoral indices, the metal one lost the most, with an erosion of 2.62 per cent. Indices for health care, FMCG (fast-moving consumer goods), banks, capital goods, and automobiles slipped between one and two per cent.

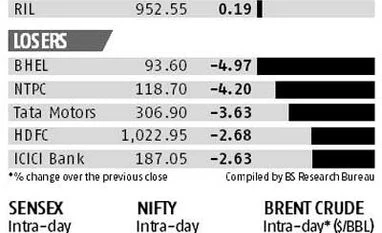

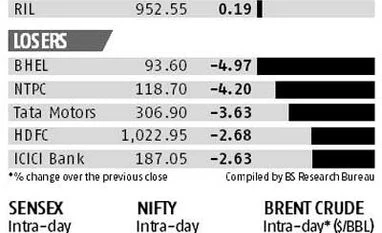

Bharti Airtel was the top gainer among Sensex stocks, with a rise of 0.9 per cent. HDFC Bank, ICICI Bank, Dr Reddy's, ONGC (Oil and Natural Gas Corporation), Tata Steel, TCS (Tata Consultancy Services), and ITC lost between two and three per cent. Tata Motors shed 3.7 per cent. NTPC and Bhel (Bharat Heavy Electricals Ltd) were worst performers, with losses above four per cent.

Anand James, co-head, research, Geojit BNP Paribas, said, "Though stocks continued slipping lower, thematic moves were visible with the Budget in view. Thus, volatility continued to dominate another day, with global cues remaining dull as oil retracted on reduced chances of talks over production cut becoming successful."

)

)