Cheer back for PE investors

After a number of successful IPOs indicate a revived market for these, 7-8 issues being readied by private equity-backed companies

Reghu Balakrishnan Mumbai Private equity (PE) investors who have been struggling for exits are finally heaving sighs of relief. As the Initial Public Offer (IPO) market has opened, with good response to the listing of PE-backed companies such as Monte Carlo Fashions, they're more optimistic.

Monte Carlo Fashions, the IPO of which was subscribed nearly eight times, diluted a 25 per cent stake to raise Rs 350 crore. PE investor Samara Capital raised around Rs 100 crore for selling around 40 per cent of its total holding of 18.5 per cent in the firm. The IPO valued Monte Carlo around Rs 1,400 crore.

Other IPOs such as of Wonderla, Snowman Logistics and Sharda Cropchem also got a good response from the public. Those of both Norwest Venture Partners-backed Snowman Logistics and agrochemical entity Sharda had been subscribed about 60 times. Snowman raised Rs 197 crore and Sharda got Rs 352 crore. Henderson Equity Partners, which had acquired 16 per cent stake in Sharda for Rs 100 crore in 2008, has made a two-fold return.

Mayank Rastogi, partner, PE, at EY, said: "The recent IPO successes have clearly demonstrated the appetite for good companies with differentiated business models. Both Sharda and Snowman had good investor response, both in terms of demand and of the opening price."

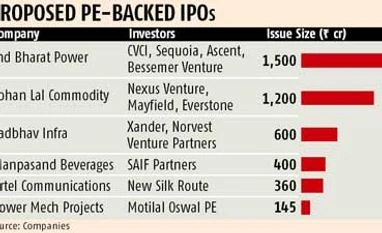

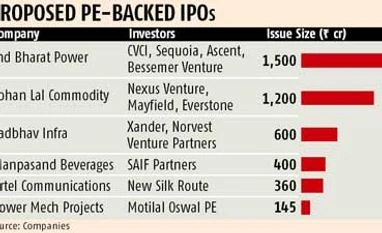

A number of IPOs are being launched by PE-backed firms such as Manpasand Beverages, NSR-backed Ortel Communication, Sadbhav Infra and Ind Bharat Power to tap the market, which has seen a comeback. "More companies with a good record, differentiated product/service strategy and good management teams should be able to have a successful listing in the near term," said Rastogi.

Sadbhav Infrastructure Project Ltd is floating a Rs 600-crore IPO which will see part-exits of PE investors Xander and Norwest, which hold about 10 per cent each in it. Vadodara-based Manpasand has filed a Draft Red Herring Prospectus with the Securities and Exchange Board of India to raise $65 million (Rs 400 crore). SAIF Partners currently owns 29.8 per cent in the company, while Aditya Birla PE holds three per cent.

Ortel Communications, a regional cable television and broadband service provider, has filed draft documents with Sebi for a public issue. Its IPO will see the exit of PE firm New Silk Route Advisors, which entered in 2008.

Darius Pandole, partner, New Silk Route, said: "If corporate results start showing the improvement that is widely expected, it is likely that the primary market window will also open after a long gap, paving the way for many public offerings."

According to reports, Ind-Barath Power Infra plans to float an IPO worth at least Rs 1,500 crore. Delhi-based agri-logistics company Sohan Lal Commodity Management is also reportedly floating one of $200 mn.

"The key to a successful public listing lies in providing sustainable returns to investors over the long term. This can only happen with companies that provide a combination of a strong management, a scalable business model with the requisite governance and a reasonably priced initial offering. Many prospective IPO's are unlikely to satisfy these criteria," added Pandole.

)

)