Putting all speculation to rest, the Subhash Chandra-led Essel group on Wednesday said it had offloaded 11 per cent of the nearly 36 per cent promoter stake in Zee Entertainment Enterprises to existing investor Invesco Oppenheimer for Rs 4,224 crore.

The deal, at Rs 400 per share, values Zee at a premium of 10.6 per cent over the current market price and will be used to pay off part of the promoter-level debt, which stands at Rs 11,000 crore. On Wednesday, Zee closed trade at Rs 361.45 per share, down 5.18 per cent over the previous day’s close on the BSE.

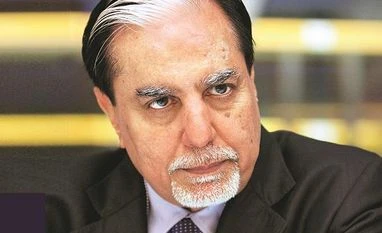

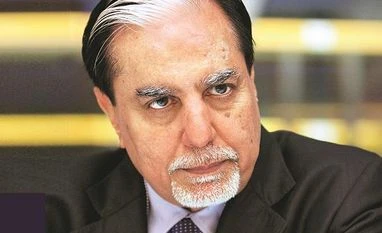

After tax, the deal would be valued at Rs 4,000 crore, said Punit Goenka, managing director, Zee Entertainment.

This means the balance — Rs 7,000 crore — of promoter debt would have to be bridged via a sale of infrastructure assets as well as an additional stake sale in Zee, said analysts.

“We believe this development to be a positive step towards meeting Zee’s desired target of stake sale by September 30,” said Ashwin Patil, senior research analyst, LKP Securities.

He added, “We expect the management to achieve success in meeting this deadline by doing a further stake sale and sale of non-media assets.”

Invesco Oppenheimer already holds 7.74 per cent stake in Zee; now, it will now hold 18.74 per cent. Promoter stake in Zee, on the other hand, will fall to just under 25 per cent post the deal.

“The fund has been a financial investor in Zee Entertainment for 17 years,” said Justin Leverenz, portfolio manager, Invesco Oppenheimer Developing Markets Fund. “This additional financial investment underscores our continued confidence in the management’s ability to deliver long-term growth and financial returns.”

Despite being the largest public shareholder in Zee, Invesco Oppenheimer will not hold a board seat, Goenka clarified in an analyst call on Wednesday.

“While interest had come from strategic and financial investors for the stake sale in Zee, we chose to go ahead with the offer from the financial investor since timelines did not permit us to delay the process,” Goenka said in the analyst call.

He added, “An investment by a strategic partner would have taken longer than the September 30 deadline that we’ve given to lenders for debt repayment.”

The Essel group had signed a formal agreement with lenders in February to pare debt.

Goenka also said the group was working out deals with prospective investors for its infrastructure assets in roads, solar and power transmission and that “non-binding offers” were on the table.

)

)