Masayoshi Son, the 60-year-old founder and managing director of SoftBank, is patient enough to wait for decades to see returns on investments made in start-ups. He is also quick to exit the ones that do not show promise.

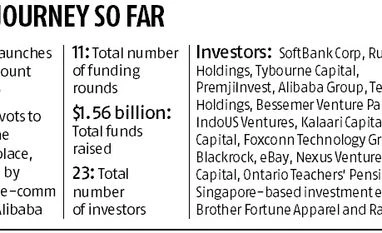

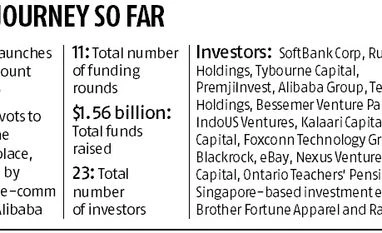

In India, he bet on Snapdeal, the Gurugram-based digital marketplace he identified in 2014 to take on rival Flipkart in the country’s booming e-commerce space. He invested $900 million in the company over two years.

Early this year, he decided his focus was misdirected. SoftBank has written off the investments in Snapdeal, and is now in talks to invest $1 billion in Flipkart, as part of a deal to merge the two online retailers.

SoftBank is getting on board Kalaari Capital and Nexus Venture Partners, both investors in Snapdeal, to hasten the sale. And, will remain an active investor in India’s e-commerce market. Son is aiming to repeat a bet he made in Alibaba, when it was a fledgling company in China.

While the value of investing in Flipkart is somewhat obscure, Son sees opportunities for a larger return later. After all, in the decade of its existence, Flipkart has more data and insights on online customer behaviour than any other in the country.

The entry of Amazon, with a $5-billion cheque and superior service, pushed both Snapdeal and Flipkart into a corner but Flipkart is getting its act together.

It outperformed Amazon during festive sales last year and has started to regain investor confidence. On Monday, Tencent, Microsoft and eBay invested $1.4 billion in the company, valuing it at $11.6 billion.

The merger could help Flipkart thwart the challenge from Amazon, though there are no gains for the founders (the Bansals of Flipkart and Kunal Bahl of Snapdeal).

According to RedSeer Consulting, Snapdeal would enable Flipkart to expand its supply chain quickly with its numerous small and big warehouses, especially in north India.

“Fast deliveries and regional fulfilment of orders have become crucial for e-retailers to achieve both higher customer satisfaction and lower supply chain costs. This move by Flipkart would be a significant boost to its quest for supply chain leadership over Amazon, which is aggressively expanding its supply chain network,” it said in a report.

The deal will also open the doors to a large, marquee investor for Flipkart: SoftBank. The additional funding firepower provided by the Japanese investor will enable the Indian e-retailer to sustain its bruising battle with Amazon for a longer period.

The deal is not without its downside. “Extracting synergies from this acquisition would be a challenging task for Flipkart, given the physical distance, differing strategies and team cultures at both companies,” says Anil Kumar, chief executive officer (CEO), RedSeer Consulting.

“However, if the post-merger integration is executed successfully, the deal could play out similar to the acquisition of Taxi For Sure by Ola in the online cab space, which gave Ola significant funding and capability firepower to hold off Uber in India.”

Others are not convinced. “First of all, these changes are being brought about by private equity funds that are trying to salvage their investments,” says Arvind Singhal, chairman and managing director of Technopak, a management consulting firm.

It is widely believed the deal is a prelude to the Flipkart Initial Public Offerings, which would give an exit to the current set of investors. Flipkart is keen on a Nasdaq listing and some time ago had hired a global consultant to prepare the company to do list by 2018.

According to senior executives in Flipkart, the company is working on streamlining its operations to meet the requirements for a Nasdaq listing.

“For more than a quarter, the company has been working on meeting the requirements of Nasdaq listing. There are a set of norms applicants have to satisfy, including a list of financial, liquidity and corporate governance requirements to be approved. An IPO launch is quite possible in the next 18 to 20 months,” says a senior executive in the know. The path to listing has been paved with the placement of Kalyan Krishnamurthy, earlier with Tiger Global, its biggest investor, as the new CEO.

)

)