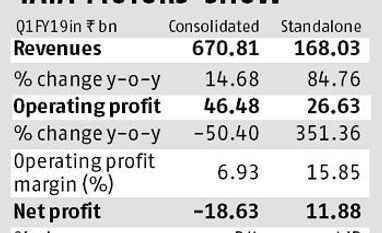

Tata Motors posted the worst bottom line performance in a decade during the April-June quarter. The company posted a loss of Rs 18.63 billion as sales at Jaguar Land Rover, its UK-based subsidiary sputtered, following a one-time regulatory issue in China, uncertainty around Brexit and poor demand for diesel vehicles in the UK and Europe.

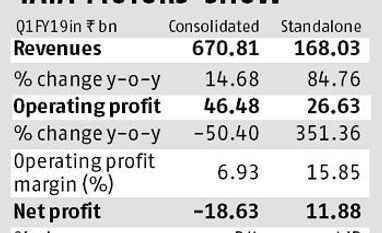

The poor JLR show offsets the strong performance at the automaker’s India unit, which posted a net profit of Rs 11.88 billion. Weak JLR show meant results, including consolidated revenues, which came in at Rs 670 billion, were way below consensus estimates, which had pegged net profit at Rs 9.19 billion on revenues of Rs 709 billion. Against the multi-year low loss, Tata Motors had posted a profit of Rs 32 billion in the corresponding quarter last year. JLR posted a loss of 210 million pounds and lower revenue of 5.2 billion pounds, down 6.7 per cent year on year, which singed earnings at the consolidated level. Top line growth of 14 per cent to Rs 670 billion was led by strong sales volumes in India, both for the commercial and passenger vehicle segments, albeit on a lower base.

Notwithstanding headwinds facing the UK unit, P B Balaji, chief financial officer at Tata Motors, said the company was confident of retaining the margin guidance of 4-7 per cent for the near-to-medium term. “The first quarter has traditionally been a weak one for JLR and fourth quarter, the strongest,” he added.

Balaji said his optimism stemmed from a strong order book of three to five months for upcoming models, including Range Rover Sport and I-PACE, continuing strong retail sales and regulatory issues in China. Also, with the pound strengthening against the dollar, forex-related impact may not be as stark as it was in the June quarter, according to the management.

With demand weak in the US, diesel-related issues in the UK and the European Union, uncertainty related to Brexit and rising trade wars, it will become difficult for the company to achieve strong volume growth. China is the only growth engine for the company as volumes in the market are expected to bounce back after an unexpected duty cut from July 1. However, analysts do not expect China growth to offset the volume pressures in key markets of the US, the UK and the EU, which accounts for 55-60 per cent of total sales.

On the India business, while the performance in the quarter was good, the new axle norms would hit industry volumes and put downward pressure on margins, analysts said. Segment performance for the commercial and passenger vehicle (CV&PV) businesses was declared for the first time in the June quarter. While the CV business recorded a strong 11.5 per cent Ebit margins (as compared to 5.5 per cent year ago), PV segment margins is inching closer to breaking even (at -0.7 per cent). Given the poor Q1 show and uncertain outlook, there could be downward pressure on the stock which closed just over a per cent in trade on Tuesday.

)

)