Limited upside for non-ferrous stocks

Since start of March those stocks have gained a little more than 50% each and by 22%

Ujjval Jauhari New Delhi The shares of non-ferrous metal producers have seen a rebound from their lows in February, when there was pessimism in the backdrop of the global economic slowdown. The reaction, though, has had only a limited upside.

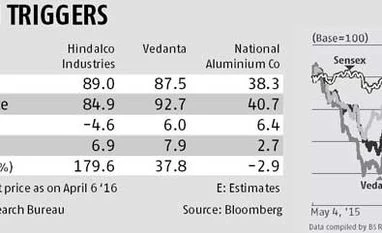

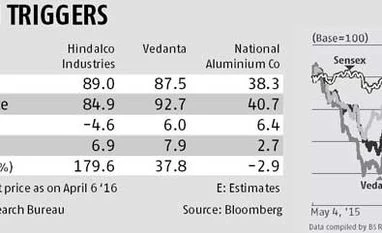

In February, stocks of non-ferrous majors such as Hindalco, Vedanta and National Aluminium (Nalco) had plummeted. Since the start of March, those of Hindalco and Vedanta have gained a little more than 50 per cent each and by 22 per cent.

Copper prices on the London Metal Exchange (LME) were $4,310 a tonne in mid-January and then rose to $5,103 a tonne on March 18. It has since dropped to $4,816. Aluminium was $1,424 a tonne in November and then $1,621 a tonne in end-February; it is now $1,523. Aluminium premiums (price above the benchmark LME rate) have stabilised.

The ferrous sector has seen steel realisations rise after the government imposed a minimum import price. The infrastructure push proposed in the Union Budget will also mean benefits in the form of higher demand.

It is not so for non-ferrous items and analysts are not bullish on the space. The consensus target prices for Hindalco and Nalco from analysts polled by Bloomberg since March, at Rs 90 and Rs 41.8, indicate limited upside from the current Rs 89 and Rs 38, respectively. Vedanta’s Rs 87.50 might have some upside, considering their target price of Rs 103.40, benefiting from contributions of Hindustan Zinc -- this alloy has been an outlier in the base metals space and prices have seen a regular rise. Hindustan Zinc is almost 70 per cent owned by Vedanta.

Hindalco, with expanded capacities, is better placed to benefit from any increase in demand and realisation. Its Novelis subsidiary is also being watched for a turnaround. Analysts at Antique Stock Broking say Novelis is expected to return to $250 million of quarterly operating earnings in the coming quarters, with stability in aluminium premiums and a higher proportion of automotive value-added products.

Nalco, being a low-cost producer, could also see strong gains. Analysts at Reliance Securities remain positive on the stock, as the cost of production of Nalco’s alumina is one of the lowest in the world, due to its high-grade captive bauxite mine.

)

)