The Chandigarh Bench of the National Company Law Tribunal (NCLT) admitted an insolvency petition against Amtek Auto, an automobile parts maker.

This comes after the Reserve Bank of India (RBI) directed public sector banks to file insolvency petitions against 12 major non-performing accounts. An insolvency professional is yet to be appointed by the tribunal, said an official in the know. Amtek Auto has total liabilities worth Rs 14,000 crore. IDBI Bank and Corporation Bank are among the lenders.

Also, global private equity entity KKR has launched bankruptcy proceedings against the company’s foreign assets. Amtek Global Technologies owes KKR $450 million. It has 19 manufacturing abroad, including in America, Britain, Mexico, Brazil, Germany, Hungary and Italy. The auto parts maker had defaulted on bond repayments close to Rs 800 crore in September 2015. It has also signed a deal with Liberty Group to sell its plant in Britain, part of an attempt to restructure by selling various group businesses.

Morgan Stanley was appointed to help reduce the debt. It had also planned to convert a loan of Rs 95 crore to shares but governance advisory firm Stakeholders Empowerment Services (SES) raised objections on how this would benefit the shareholders.

Amtek Auto is the odd one out in the set of bad loans that have been referred to NCLT after the RBI order. Other companies are from the steel and power sector. After the insolvency petition was filed, two of its board members gave their resignations.

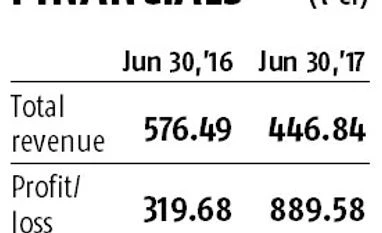

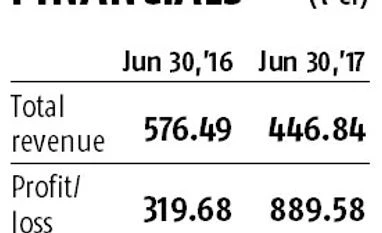

Experts say the company went into this state due to a string of acquisitions abroad. The problems began making news in 2015, when CARE ratings suspended Amtek’s bond ratings and JP Morgan froze redemptions. The company reported standalone losses of Rs 889.6 crore for the quarter ending this June, more than double the loss in the same period a year before. Total income from operations during the quarter was Rs 447 crore, down 13.4 per cent from a year before.

The stock closed almost five per cent higher on Monday on the BSE, at Rs 31.15. With admission of the case at NCLT, the company gets 180 days to restructure, extendable by 90 days. If this fails, the assets will be liquidated.

)

)