State-owned Power Finance Corporation (PFC) could see around 11.4 per cent of its loan book getting into the insolvency route. This includes debt-laden thermal power projects, stranded gas and hydro power units.

Officials said 14,115 Mw of capacity, at an estimated Rs 300 billion exposure to PFC, will go under insolvency proceedings.

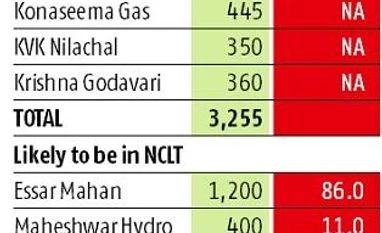

In fact, a total of 3,255 Mw projects, have already been taken to the National Company Law Tribunal (NCLT) by either PFC or one of the key bankers among the consortium of lenders, an official said. Rest of the projects, around 10,000 Mw, have six months for resolution. The time is too little, given the regulatory hurdles, he added. So, the remaining 10,000 Mw of projects could also land up in NCLT.

Those already before NCLT under the Insolvency and Bankruptcy Code (IBC) include the Konaseema gas power plant (445 Mw), coal projects of East Coast Power (1,320 Mw), KVK Nilachal (350 Mw), Ind-Barath Madras (660 Mw), Krishna Godavari (360 Mw) and the hydro power plant of JAL in Sikkim (120 Mw).

The bigger worry is about projects which have six months or less to get resolved or land before NCLT. A recent Reserve Bank of India (RBI) notification, titled ‘Resolution of stressed assets — Revised framework’, mandates banks to classify even a one-day delay in debt servicing as default. And, that resolution proceedings against stressed accounts are to be completed in 180 days. Though the directive is to banks and PFC is a non-banking financing company, its assets also get covered by this, since PFC loans are in a consortium with banks.

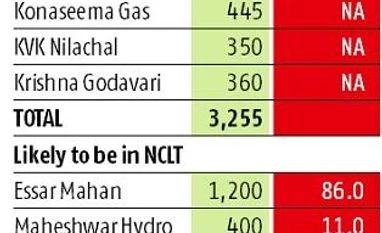

Among those on the brink of insolvency are Essar Mahan (1,200 Mw), the Maheshwar hydro project (400 Mw), GMR Chhattisgarh (1,370 Mw), KSK Mahanadi (1,800 Mw), Nashik (1,350 M2) and Amravati (2,700 Mw) power projects of RattanIndia and Utkal (120 Mw).

In the case of GMR Chhattisgarh, the lead banker, Axis Bank, had called for bids to acquire the project. Adani Power, Torrent Power and JSW Energy had bid but the deal could not be concluded by the deadline of February 28. Sources said Axis had sought an extension of time. “In case no bidder emerges as the final buyer, GMR Chhattisgarh would also land up at NCLT. As for the rest of the projects, the RBI notification has complicated the matter. Six months is very little time for power assets to be sold,” said an executive with one of the companies listed here.

PFC and the other lenders are expecting a haircut (the term for a write-off) of more than 50 per cent when these assets go through the insolvency route. Power generation assets have a problem in finding buyers due to several regulatory hiccups. For four years, no state government has signed a long-term power purchase agreement, hurting the bottom line at generation projects. Coal supply has been eased through several government schemes but is yet to uplift languishing power generation. Several years of cases filed before regulatory commissions and courts are another hurdle for potential buyers.

Unlike the steel sector, where the promoters have been reluctant to sell and even wanted to bid for their own insolvent companies till an ordinance last year barred them, power projects find it difficult to get buyers. About 25,000 Mw of stressed capacity in thermal power is already on sale outside of the IBC. Business Standard reported recently that these assets were not finding buyers. Most promoter companies of the projects — some operational and others still under development — want to exit, to lighten their debt.

)

)