RIL result preview: Sequential decline in GRMs to impact profit

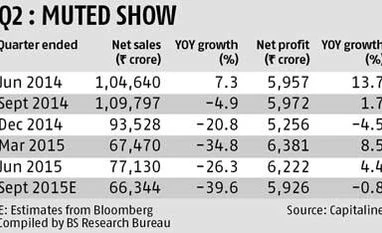

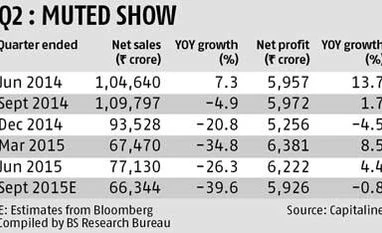

Bloomberg poll suggests consolidated net profit is estimated at Rs 5,926 crore and net sales at Rs 66,343 crore

Kalpana Pathak Mumbai Reliance Industries (RIL) is expected to post a four to five per cent drop in consolidated net profit for the September quarter from the one in June, on the back of lower gross refining margins (GRMs).

Scheduled to announce its results on Friday, the consolidated net profit is estimated at Rs 5,926 crore and net sales at Rs 66,343 crore, a poll of analysts by Bloomberg shows. Earnings before interest, taxes, depreciation and amortisation (Ebitda) is pegged at Rs 8,980 crore.

On a year-on-year basis, though, net profit is expected to be down marginally, by 0.8 per cent, by Bloomberg estimates.

RIL operates in petroleum refining, petrochemicals, oil and gas exploration and production, telecom and retail sectors.

Analysts estimate the GRMs at $8.5-9 a barrel, tracking the 23 per cent quarter-on-quarter fall in Singapore benchmark GRMs (to $6.3) and expected inventory losses amid a 20 per cent fall in oil prices.

GRM is the earnings from turning every barrel of crude oil into fuel. RIL typically reports a GRM of $2-3 a barrel above the Singapore GRM. Brent crude averaged $50 a barrel in the September quarter, against $102 a barrel in the same quarter of FY15 and $62 a barrel in the June quarter.

“We expect RIL’s GRM to fall 14 per cent quarter-on-quarter to $9 a barrel, nonetheless a $2.8 a barrel premium over the Singapore benchmark. Diesel cracks declined $3.2 a barrel quarter-on-quarter, which will impact the company, given its 45 per cent exposure,” said Edelweiss Securities.

RIL’s refining business contributed about 65 per cent to the overall segment profits (Ebit, earnings before interest and taxes) and 70 per cent to overall revenues in the June quarter. The petrochemical operations have the second biggest share, 20 per cent of revenue and 30 per cent of profit.

“Lower GRMs will only partly be offset by a four per cent quarter-on-quarter higher refinery throughput, as the last (June) quarter was impacted by a planned shutdown and refining Ebit is likely to fall by six per cent, quarter on quarter,” said CLSA Research.

The year-on-year performance of the refining business, though, will be better as GRMs are up seven per cent. According to Morgan Stanley Research, Reliance is expected to report a refining Ebit of Rs 4,500 crore, up 18 per cent over a year.

Petrochemical margins are expected to improve, with a 23-27 per cent surge in polymer and polyester spreads over the June quarter. Year on year, the petrochemical Ebitda margin is expected at 18 per cent, against 12 per cent earlier.

The exploration and production business could yet again be a drag on the performance, due to both domestic oil and gas production, and US shale oil and gas being impacted by lower prices and production. Analysts said they expected poor performance in the segment to continue.

“We have assumed flattish gas production from the K-G basin on a quarter on quarter basis, at 11.3 million standard cubic metres a day,” said an Emkay Research report.

The scrip ended nearly flat at Rs 904 at the BSE exchange on Thursday.

)

)