Tata Motors does not plan to chase market share in trucks and buses by offering steep discounts.

Tata Sons, the Tata group holding company, said Tata Motors' share of the commercial vehicle market hit an all-time low of 40 per cent under former chairman Cyrus Mistry. Trucks are the mainstay of Tata Motors' business in India.

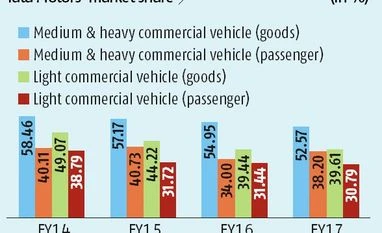

Following Mistry's ouster in October, Tata Sons had highlighted the decline in Tata Motors' market share of passenger vehicles from 13 per cent in 2012-13 to 5 per cent and in commercial vehicles from 60 per cent in 2012-13 to 40 per cent, the lowest in the company's history as the market leader of the segment.

"If we start looking at market share at any cost, and aim to get back to over 60 per cent, that will drive the whole industry down," said R Pisharody, executive director for commercial vehicles at Tata Motors.

Tata Motors has lost market share in buses to Ashok Leyland and in smaller trucks and passenger carriers to Mahindra & Mahindra and Force Motors in the last three years. Its leadership is now restricted only to big trucks, although in December Tata Motors was neck and neck with Ashok Leyland in orders for buses by state transport departments.

"We still hold 55 per cent market share in medium and heavy commercial vehicles (MHCVs) and in last 18 months we did not lose any market share. We had lost some share earlier," Pisharody said.

He added Tata Motors had stayed away from discounting beyond a point. "We have experience that shows discounts do not get you anywhere," he said.

"When you get a pick-up at Rs 4.5 lakh, it becomes difficult for a customer to go for an Ace (Tata Motors' best-selling pick-up truck). With the launch of Ace Mega, we are gaining market share. Xenon Yodha was launched in the traditional pick-up format in January," Pisharody said.

The company is working on a combination of products and marketing to ensure that its market share climbs. Tata Motors recently signed actor Akshay Kumar as brand ambassador for the commercial vehicle business.

)

)