Wholesale inflation at 5-year low

Falls to 3.7% in August; all key segments see decline

Indivjal Dhasmana New Delhi

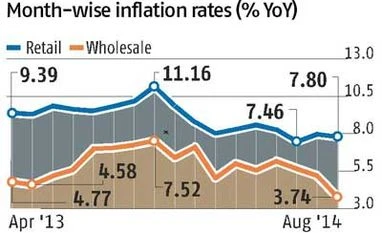

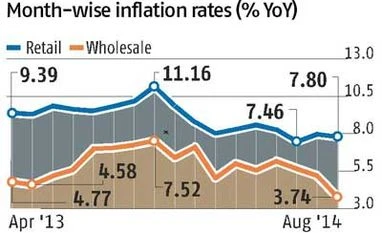

The wholesale price index (WPI) -based inflation rate fell to a 58-month low of 3.74 per cent in August from 5.19 per cent the previous month, as the pace of price rise slowed across all broad categories, including food, official data showed on Monday. The rate had stood at 6.99 per cent in the same month last year.

The wholesale inflation rate in August, the lowest since the 1.78 per cent seen in October 2009, is well within the Reserve Bank of India’s (RBI’s) comfort zone of five per cent.

While the inflation rate for primary articles fell to 3.89 per cent in August from 6.78 per cent in July, that for fuel & power eased to 4.57 per cent from 7.40 per cent. The rate of rise in prices of manufactured items declined to 3.45 per cent from 3.6 the previous month.

The rate of increase in the prices of food, a segment for which the government has come under attack in recent times, declined to 5.15 per cent from 8.43 per cent a month earlier.

In line with the moderation in headline numbers, core inflation (for manufactured products excluding food items) eased to a seven-month low of 3.45 per cent in August from 3.58 per cent in July, mainly due to lower prices of imported commodities, said YES Bank Chief Economist Shubhada Rao.

Rao added that the trends emerging in global prices of commodities, especially crude oil, besides a controlled increase in food prices so far in September, suggested that the wholesale inflation rate might ease to 3.00-3.25 per cent this month.

Data released late last week had shown the consumer price index-based (retail) inflation rate had also declined to 7.8 per cent in August - within RBI's target of eight per cent by January next year.

Given that the rates of both wholesale and retail inflation are easing and have come within RBI's comfort zone, industry is now seeking a cut in the repo rate - the rate at which RBI lends to banks. Growth in the country's industrial activity had in July declined to 0.5 per cent, the lowest level so far this financial year.

The central bank, however, is widely believed to keep the policy rate intact in its monetary policy review on September 30, as the risks to retail food inflation persist because of a weak monsoon. Besides, the easing in food inflation in August could largely be attributed to a high base of 19.17 per cent in the same month last year.

"The drop in primary food inflation in August should be interpreted with caution, as it might have benefitted from a favourable base effect... Lower and delayed sowing this year, compared with last year, remains a concern for crop yields and food prices," said ICRA Senior Economist Aditi Nayar.

Also, RBI might still not be comfortable as the bigger target for it is bringing the retail inflation rate down to six per cent by January 2016.

Rao also said lower wholesale core inflation, amid a moderation in retail inflation, was likely to give some near-term comfort to RBI. But any room for monetary policy easing might open up only around the April-September quarter of next financial year - and that if the government's policy action made it visible that RBI's second goal post was within reach, she cautioned.

The decline in food inflation has not been uniform. The rate for potatoes, for instance, rose to 61.61 per cent in August from 46.41 per cent a month earlier. In contrast, the price of onions in the month fell 44.70 per cent from that a year ago. In fact, prices genuinely declined in the case of onions, as the vegetable turned 0.24 per cent cheaper on a monthly basis. But tomatoes in August turned 70.06 per cent more expensive on a year-on-year basis.

)

)