Centre targets to raise farm household income to Rs 2 lakh by 2022-23

The committee strongly recommends stepping up of institutional credit on a large scale

)

Explore Business Standard

Associate Sponsors

Co-sponsor

The committee strongly recommends stepping up of institutional credit on a large scale

)

The Centre’s earlier declared aim of doubling farmer household income by 2022-23 would need additional public and private investment of Rs 6.4 lakh crore, at current prices.

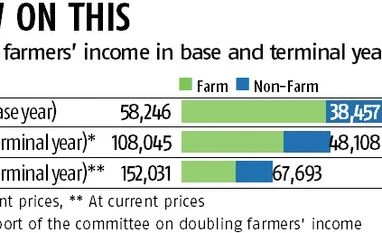

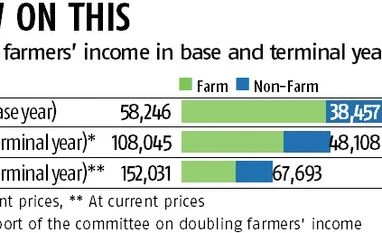

The figure has been estimated in an initial report of the official committee on the subject. Average income of a farmer household was estimated at Rs 96,703 in 2015-16; this is supposed to rise, by government effort, to Rs 2,19,724 (at current prices) by 2022-23.

The initial report details seven main factors in this regard. Better crop and livestock productivity are among these, as are better prices in real terms received by farmers. The first four volumes of the 14-part report were made public on Monday.

The targeted 127 per cent increase in income will lead to the share of farm income in total farmer household income rising from 60.2 per cent in 2015-16 to 69.2 per cent in 2022-23.

At constant prices, the average income of a farmer household is targeted to be increased to Rs 1,56,154, from Rs 96,703. Income at current prices is calculated by assuming an average yearly inflation rate of five per cent.

The Committee on Doubling Farmers’ Income is headed by Ashok Dalwai, chief executive of the National Rainfed Area Authority. The income estimates are of the panel.

In total income, 69 per cent would come from core farm activities. For the targeted 10.4 per cent annual increase in farmers’ income from 2015-16 to 2022-23, the draft report said an additional private investment of Rs 1,31,840 crore is required at 2011-12 prices, besides public investment of Rs 5,08,080 crore.

This requirement for private investment varies across states, from Rs 126 crore to Rs 14,665 crore. That of public investment varies from Rs 400 crore to Rs 94,600 crore. The report says public investment is below the national average in Assam, Kerala, Uttar Pradesh, Madhya Pradesh, Bihar, West Bengal, Tamil Nadu, Rajasthan, Punjab and Odisha.

The estimated needed increase in weighted public investment - together in agriculture, irrigation, rural roads and transport, and rural energy - is pegged at 14.17 per cent annually.

The committee strongly recommends stepping up of institutional credit on a large scale. Only 50-60 per cent of the investment requirements of farmers are being met through institutional loans.

It cautions that an income support system isn’t a long-term solution for tackling farmer distress, particularly in the backdrop of depleting natural resources and uncertainty caused by climate change, as also the dependence of a huge labour force on the farm economy.

On developing of marketing infrastructure, it says all states must adopt the model Agricultural Produce Marketing Committee (APMC) Act drafted by the Centre. The agriculture ministry must discuss this with states to make it operational without delay. Also, that about 10,000 wholesale and 20,000 rural retail markets are needed to achieve the desired market density and network these into a pan-India system.

Preventing the post harvest loss in fruit and vegetables would, it says, mean annual saving of Rs 62,000 crore, at 2014 prices. Good enough to finance 70 per cent of the investment required for specialised infrastructure to ensure cold-chain integration.

It also said a key aspect of doubling farmers’ income is to focus on export. The aim should be to raise agricultural export by a minimum of three times by 2022-23, to reach $100 billion (Rs 6.4 lakh crore). And, go beyond cereals and meat, at present the bulk of our export. All of which require a stable duty structure, for import, too.

It suggests a permanent inter-ministerial committee, including those of commerce, consumer affairs and agriculture. This would monitor domestic and global prices for different commodities, recommending on needed changes, keeping in mind the conflicting interest of producers and consumers.

It also recommends procurement of more commodities, with a threshold limit.

First Published: Aug 14 2017 | 10:35 PM IST