Current value of rupee reasonable, says Rajan

While 'currency is a complicated animal', RBI guv says India should be wary of side-effects

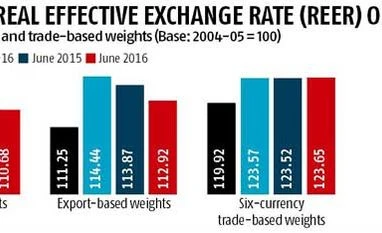

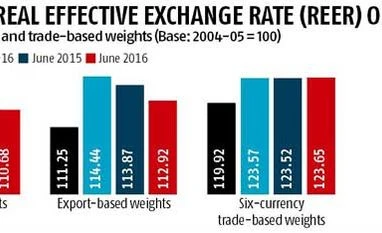

B Dasarath Reddy Hyderabad India’s rupee was reasonably valued and a devaluation of the currency would spur inflation and not necessarily help exports, Reserve Bank of India (RBI) Governor Raghuram Rajan said here on Monday.

Pointing out that “currency is a complicated animal”, Rajan said some of the emerging market counterparts, such as Brazil, which have had significant devaluations, haven’t necessarily seen a tremendous expansion in their exports. “So, we have to be a little careful in saying devaluation is the answer,” he said, responding to queries posed by the audience at the National Seminar on financial inclusion.

The outgoing governor said devaluation had a lot of side effects, including that inflation would pick up. “Broadly, my belief is the value of the rupee is pretty reasonable and I don’t think we should emphasise moving one way or the other as the answer to any problem.”

In his communication to RBI staff on June 18, Rajan had said that the currency stabilised, thanks to the central bank’s actions. “Our foreign exchange reserves are at a record high, even after we have fully provided for the outflow of foreign currency deposits we secured in 2013,” he said.

India’s foreign exchange reserves stood at $361.94 billion at the end of June 8. It closed at 67.20 on Monday. The Indian currency had come under attack in May 2013, after US Federal Reserve System Chairman Ben Bernanke spoke of gradual withdrawal of easy money policy. It fell from 53.82 at the beginning of May to an all-time low of 68.83 to a dollar at the end of August 2013.

The governor said cheaper price for goods and services might allow India to export more, but it also meant that imports became costlier. “Often, exporters import a lot of what they export. So it is not obvious that just devaluing helps everybody,” Rajan said.

Responding to a query on India reaching the per-capita gross domestic product (GDP) level of China, Rajan said China’s GDP was four times that of India today. Rajan, whose three-year term as RBI governor ends in September, has been instrumental in curbing price gains, while also helping lift the rupee from an all-time low seen just days before he took charge in 2013.

)

)