Defensive FM says loan write-offs don't lead to waivers, recovery still on

He said public sector banks have recovered Rs 365.51 billion of bad loans or NPAs during April-June quarter

)

Explore Business Standard

Associate Sponsors

Co-sponsor

He said public sector banks have recovered Rs 365.51 billion of bad loans or NPAs during April-June quarter

)

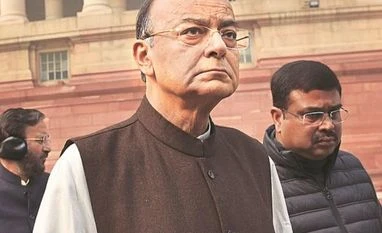

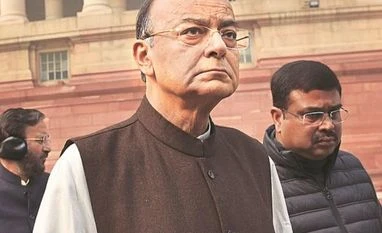

Finance Minister Arun Jaitley on Monday defended loan write-offs by public sector banks, saying they do not lead to loan waivers and the exercise helps lenders clean up their balance sheets and achieve taxation efficiency.

He said public sector banks have recovered Rs 365.51 billion of bad loans or NPAs during April-June quarter of the current financial year as compared to Rs 745.62 billion recoveries made in the full 2017-18 fiscal.

Commenting on reports that the country's 21 state-owned banks wrote-off Rs 3.16 trillion of loans in four years of the BJP government and made recoveries of Rs 449 billion of written off loans, Jaitley in a Facebook blog said "technical write-offs" are resorted to by banks as per the Reserve Bank of India (RBI) guidelines.

"This, however, does not lead to any loan waiver. Recovery of loans continues rigorously by banks," he said. "In fact the defaulting management of most insolvent companies have been removed under the Insolvency and Bankruptcy Code (IBC)."

Congress President Rahul Gandhi used the report to attack the government, saying demonetisation converted black money into white and Rs 3.16 trillion of loans were written off.

"Modi's India - For Common Man: Notebandi-line up and put your money in banks. All your details into Aadhar. You can't use your own money. For Crony capitalists: Notebandi-convert all your black money to white. Let's write off 3.16 trillion using common man's money," Gandhi said in a tweet.

First Published: Oct 01 2018 | 7:35 PM IST