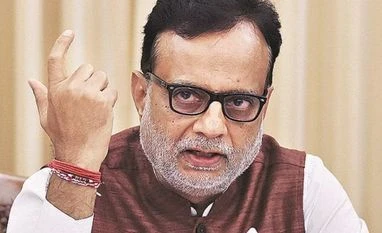

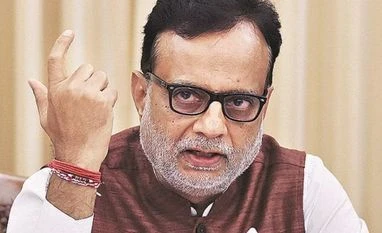

LTCG tax kitty from stocks to double to Rs 400 bn in FY20: Hasmukh Adhia

In the Union Budget 2018-19, Finance Minister Arun Jaitley has imposed a 10 per cent tax on LTCG made in the share market to curb tax evasion

Press Trust of India New Delhi The government hopes to double its revenue from long-term capital gains (LTCG) tax on stocks to Rs 400 billion in 2019-20 as more share transactions come in its fold with the waning of the grandfathering effect, a top official has said.

Defending the reintroduction of the tax after a gap of 14 years, Finance Secretary Hasmukh Adhia said if the salaried class pays up to 30 per cent income tax after toiling, it is only fair that those who make huge returns on stock market investment are brought into the tax net.

Adhia said a huge Rs 3.67 trillion, as per the I-T returns filed for Assessment Year 2017-18, has been exempted from tax as it under the LTCG from listed shares.

In the Union Budget 2018-19, Finance Minister Arun Jaitley has imposed a 10 per cent tax on LTCG made in the share market to curb tax evasion.

However, all gains made up to January 31, 2018 have been grandfathered, meaning that they will not be taxed.

In an interview to PTI, Adhia said the calculation of capital gains on equities held currently by an investor would be based on the price of the stock as of January 31, 2018.

"In the first year (2018-19), we will get Rs 200 billion (from long term capital gain tax) because we have grandfathered. Next year (2019-20) onwards, it would be about Rs 400 billion," he said.

Currently, 15 per cent tax is levied on capital gains made on sale of shares within a year of purchase. However, LTCG tax is nil for shares sold after a year of purchase.

From April 1, start of the new financial year, LTCG gains exceeding Rs 1 lakh will be subject to 10 per cent tax.

Adhia said: "This is the first year when we started asking for reports on this. We have got startling Rs 3.76 trillion being reported as exempted income. Isn't that too much? Just imagine you as salaried class would have earned this much income, you pay 30 per cent tax for your toil.

"And here is a return on simple investment. You have money, you put in stock and you make capital gain and then you pay no tax".

In his Budget speech, Jaitley had said that a major part of the gain has accrued to corporates and LLPs which has created a bias against manufacturing, leading to more business surpluses being invested in financial assets.

The return on investment in equity is already "quite attractive even without tax exemption" and therefore there is a strong case for bringing long term capital gains from equities in the tax net, Jaitley had said.

)

)