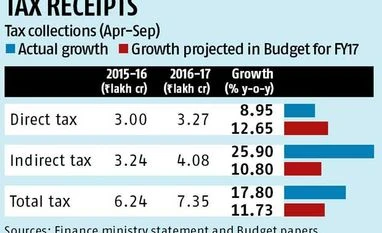

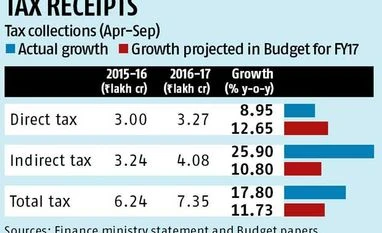

Driven by indirect tax receipts, overall tax collections rose 17.8 per cent in the first half of the current financial year against almost 12 per cent targeted in the Budget for the entire 2016-17. Growth in direct tax collections at 8.95 per cent during April-September was less than 12.65 per cent projected in the Budget due to 27 per cent higher refunds (year-on-year) and subdued corporation tax receipts.

The bad news on the direct taxes front came close to less than expected collections from spectrum. Against Rs 64,000 crore projected in the Budget, spectrum auction will fetch just Rs 32,000 crore this financial year.

Read our full coverage on Union Budget 2016 Taxes yielded the government Rs 7.35 lakh crore in April-September 2016 against Rs 6.24 lakh crore a year ago. The tax collections were 45 per cent of Rs 16.31 lakh crore estimated for the entire financial year in the Budget.

Direct tax collections up to September are at Rs 3.27 lakh crore against Rs 3 lakh crore during this period. Till September, 38.65 pre cent of the Budget Estimates (BE) at Rs 8.47 lakh crore has been achieved, which would require higher mop-up in the second half vis-a-vis the first one to meet BE.

Corporation tax rose 2.56 per cent, while personal income tax collections grew 18.6 per cent. While corporation tax receipts were woefully short of 9.04 per cent growth projections in the Budget for 2016-17, personal income tax revenues were more or less in line with 18.09 per cent rise projected in BE.

If refunds to the tune of Rs 86,491 crore are included in tax collections, corporation tax collections would show 9.5 per cent growth and personal income tax 18.6 per cent y-o-y.

Advance tax collections touched Rs 1.58 lakh crore in the first half of 2016-17, representing a growth rate of 12.12 per cent. Corporation tax rose 8.14 per cent, while personal income tax grew 44.5 per cent. The high growth rate in personal income advance tax was also due to the fact that 45 per cent of it has to be paid in the first half from the current financial year against 30 per cent in earlier years.

Almost Rs 15,000 crore would also come to the personal income tax kitty from the declarants under black money window in the second half. The figure could be bit higher as final numbers were still being counted.

Indirect tax collections rose 25.9 per cent at Rs 4.08 lakh crore in the first half of the current financial year. This was more than the 11 per cent growth projected in the Budget for the entire 2016-17.

During April-September this year, 52.5 per cent of BE of indirect taxes at Rs 7.8 lakh crore for 2016-17 has been achieved.

Excise duty mop-up was higher by 46.3 per cent at Rs 1.83 lakh crore in these six months compared to Rs 1.25 lakh crore in the corresponding period of the previous financial year. The Budget projections were 12.15 per cent for excise duty growth during the current financial year.

Service tax was up 22.1 per cent to Rs 1.17 lakh crore in April-September 2016, compared to Rs 95,780 crore in the corresponding period of 2015-16. The growth estimated in the Budget was 10 per cent for the entire 2016-17.

Customs duty fetched Rs 1.08 lakh crore in the first half of the current financial year, up 4.8 per cent over Rs 1.03 lakh crore in these six months of 2015-16.

Contraction in imports pulled down growth in collections under this head as the Budget has projected a 9.78 per cent rise in mop-up for 2017-18.

The government will receive just Rs 32,000 crore from spectrum auction against Rs 64,000 crore it projected in the Budget for the current financial year. The government might have to look for another Rs 15,000 crore, even if one assumes that tax, including penalty and a cess, would give the government around Rs 17,000 crore against initial estimation of Rs 15,000 crore under the black money window.

)

)