Bankers wary of Gammon's making loans equity

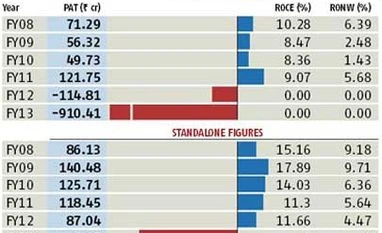

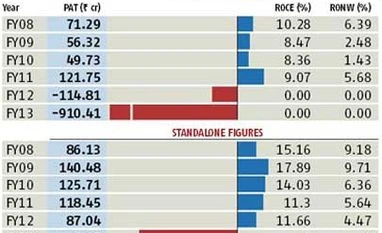

Return on equity of the company has turned negative since the last 2 years as the company is making huge losses on a consolidated basis

Dev Chatterjee Mumbai Lenders to beleaguered infrastructure firm Gammon India are apprehensive of a corporate debt restructuring (CDR) proposal that seeks to convert bank loans into equity at a premium to the current market price.

A senior banker said the conversion of Gammon’s loans into equity was an option open to banks, according to the CDR package. “But the company has not approached us for permission in this regard. In case such a request comes, a call can be taken on whether to do the conversion and at what price,” a banker said.

On Thursday, the Gammon India stock closed at Rs 13.72 on BSE. The loans are sought to be converted at Rs 27 a share, a premium of about 100 per cent. The return on equity of the company has turned negative since the last two years, as it is making huge losses on a consolidated basis.

Indian public sector banks already recorded a huge loss when they converted a part of their loans to Kingfisher Airlines to equity. Since then, the company’s stock kept falling and the banks booked huge losses. As of now, Kingfisher Airlines, which has stopped operations, owes Rs 7,000 crore to public sector banks.

In recent months, RBI Governor Raghuram Rajan and Deputy Governor K C Chakrabarty have raised concern on rising non-performing assets and restructuring of loans in the banking sector.

According to BSE data, promoters hold 35 per cent stake in Gammon India. If the loans are converted into equity, this stake would fall considerably.

The company had sought the CDR package, saying the construction industry had been facing a severe recessionary trend due to the decelerated economy, slower industrial growth and delays in large public sector projects. These, the company said, led to delays that resulted in the profitability of certain projects being eroded. The company also blamed delayed receivables, stagnation in revenues and high interest costs, adding expansion into non-core areas did not yield expected returns, resulting in liquidity mismatches and an increase in borrowings.

According to a BSE statement dated November 26, Gammon said it planned to issue up to 3.4 million equity shares of Rs 2 each at Rs 27 an equity share to CDR lenders on a preferential basis, on conversion of fund-based facilities (working capital term loan and funded interest term loan) aggregating Rs 930 crore, at any time during the implementation of the CDR package.

The company also sought to issue up to 1,343,371,534 equity shares at the same price to the CDR lenders on a preferential basis on conversion aggregating Rs 3,634 crore , on a default and/or any amount outstanding beyond seven years. The company also sought shareholders’ approval to provide for conversion of restructured debt aggregating Rs 14,814 crore into equity shares.

)

)