Lenders order special audit of Amtek books

Set stiff terms for fresh loans for bond repayments; May ask promoters to pledge more of their holding; Could insert a strategic debt restructuring clause

Abhijit Lele Mumbai Lenders to Amtek Auto group have decided to go for a special audit of the books of various group companies before providing fresh loans to help it repay Rs 800 crore of bonds coming up for redemption on September 20.

While details of the action plan would differ from case to case, lenders would also ask the promoters to pledge more of their holdings and sell some group companies to generate resources. In addition, promoters would be required to bring their own resources to indicate their skin in the game, a bank executive said.

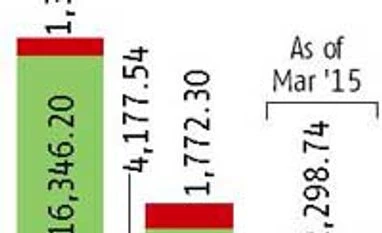

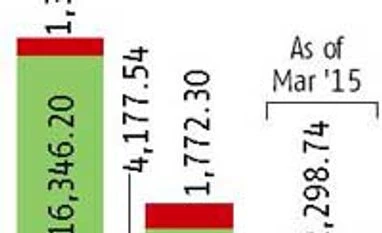

A Joint Lenders Forum is working on the contours of the corrective action plan, a senior public-sector bank official said. Banks have a Rs 26,000-crore exposure to the group; of this Amtek Auto accounts for over Rs 7,800 crore.

Banker said lenders might also look at inserting a clause for strategic debt restructuring (SDR), which would empower them to acquire a 51 per cent stake or more in the flagship company or other group companies to recover bad loans.

In June, the Reserve Bank of India (RBI) had allowed banks to hold 51 per cent or more of the equity after a debt-for-share conversion. Under this, banks will have to closely monitor the performance of a company and appoint professional management to run it. At the same time, the banks themselves should try and sell their stake "as soon as possible".

The plan is being drafted under the 'early recognition and early resolution of stressed assets' framework. RBI had in 2014-15 prescribed this framework to nudge lenders to be proactive in spotting stressed accounts and take prompt steps.Delh-based Amtek group is an integrated auto and non-auto component manufacturer with presence in 11 countries. It has combined revenues of over Rs 20,000 crore and presence in segments like forging and castings.

The group had made a string of acquisitions in the country and abroad, in the automotive segment. But these failed to match the projected revenues due to an economic slowdown and slump in demand. This put pressure on Amtek Auto's finances, prompting it to seek funding support from banks.

It is, however, still a standard account, as the company has paid the interest component on schedule. But with a pressure on revenues, bankers have put a question mark over its ability to pay instalments in future.

Earlier this week, rating agency CRISIL downgraded the long-term bank rating for group company JMT Auto to 'BBB-' from 'BBB+', on deterioration in credit profile marked by a shrinking revenue and profitability.

JMT Auto's financial flexibility is likely to be affected substantially after a significant deterioration in its majority shareholder Amtek Auto's credit risk profile. Amtek Auto holds a 70.74 per cent stake in JMT Auto.

This is the second time that Amtek Auto has found itself in a tight spot. It was affected by the global financial crisis of 2007-08 along with many other Indian companies, due to its exposure to foreign exchange derivatives. The company had informed stock exchanges in March 2008 that it could potentially make a loss of up to $18 million (Rs 72.18 crore) in the next two years, given its exposure to currency hedges and swaps. Its promoters had then promised to bring in a matching amount to meet the obligation, should that arise, in the form of 10-year, interest-free non-convertible debentures or preference shares.

)

)