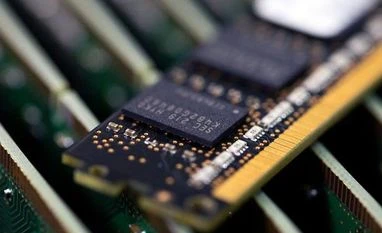

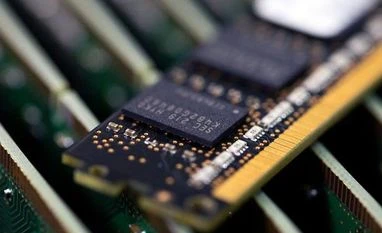

China finds microchip acquisition difficult due to US-imposed barriers

China has been ruthless in its attempts to acquire high-end microchips as it imports more than $300 bn worth of semiconductors each year

)

Explore Business Standard

China has been ruthless in its attempts to acquire high-end microchips as it imports more than $300 bn worth of semiconductors each year

)

China has been ruthless in its attempts to acquire high-end microchips as the country imports more than $300 billion worth of semiconductors each year. The country, however, finds it difficult to acquire microchips amidst the US-imposed barriers, according to a report by the Indo-Pacific Centre for Strategic Communications (IPCSC).

The report also states that due to the restrictions, "China is finding it tough to train artificial intelligence systems and power advanced applications in the military and surveillance fields".

The US administration in October put a set of export controls on China which included measures that stop Beijing from acquiring from anywhere in the world, semiconductor chips with US equipment.

Since then, even Europe and its allies have been working towards ensuring that Beijing doesn't procure high-end microchips from anywhere in the world.

As a result, Chinese firm, Si Microelectronics was in November blocked by Germany from taking over chip-making factory Elmos. The country also blocked Chinese investment in the Bavaria-based ERS Electronic.

The UK government in the same month barred Chinese firm Wingtech from taking over the country's largest microchip factory Nexperia.

"In 2021, South Korea supplied around $76.8 billion, or 60 percent of its total microchips export to China. But one year after its usual semiconductor business with Beijing, Seoul, according to South China Morning Post, is under pressure to side with the US-led alliance in stopping China from getting high-quality chips. However, South Korean semiconductor manufacturers Samsung and SK Hynix which have factories in China have been granted a year-long exception from US export restrictions," reported IPCSC.

The IPCSC report also said that China has in the past 30 years, spent billions of dollars to build a domestic semiconductor industry. Chinese semiconductor companies, however, make up a small part of the international market and these companies do not produce high-end chip technologies.

Recently, Geopolitica.Info reported that Germany by blocking the sale of two semiconductor factories to Chinese companies showcased that it "will not allow China to swallow up its companies of strategic and critical importance".

Berlin's decision comes despite German Chancellor Olaf Scholz's visit to China in November amid criticism by lawmakers from his country and the European Union.

Olaf Scholz visited China to strengthen bilateral economic engagement between the two nations at a time when China and Germany were celebrating 50 years of diplomatic ties. Despite Scholz's visit, Germany blocked the sale of two semiconductor factories to Chinese companies, citing security threats.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)

First Published: Dec 22 2022 | 3:48 PM IST