Broking business looks down even as Sensex scales new peak

Segment under stress, with retail participation down and falling volumes in secondary markets

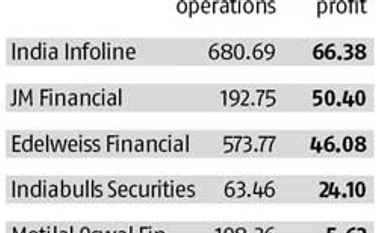

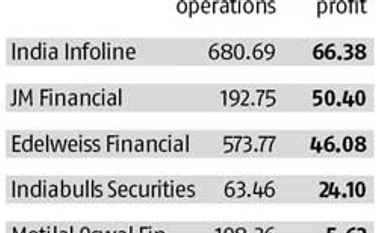

Sachin P Mampatta Mumbai The Sensex may have hit a new all-time closing high but the broking business sees bleak prospects. The proportion of earnings from broking is shrinking for financial service organisations that are the biggest in this segment. Broking was barely five to 12 per cent of revenue for three of the four listed entities which had declared their results for the three-month period ending in September. India Infoline, Edelweiss and JM Financial all show limited reliance on the segment, show their latest results.

Total income for IIFL was up about one per cent over the previous quarter and 4.6 per cent over the same period last year to Rs 683 crore but broking contributed to only 12.1 per cent of it. Broking revenue was a tenth of JM Financial’s total operating income of Rs 247.7 crore in the quarter. And, securities broking contributed to 5.5 per cent of Edelweiss’ total revenue. The company declined further comment on the segment, stating it no longer wished to be perceived as a broking company.

For Motilal Oswal, broking and related activities continued to be the mainstay of the business, contributing a little over 60 per cent of the revenue of Rs 116 crore. Broking revenues were flat over a year and up eight per cent quarter-on-quarter, even as overall revenue was up by two to five per cent.

Sameer Kamath, chief financial officer at Motilal Oswal, suggested retail participation continued to remain muted. “The markets are at new highs but retail participation seems to be at a new low. They have not participated in the rally and have kept away due to the volatility over the last quarter. If the momentum sustains, confidence could return,” he said.

Nimesh Kampani, chairman, JM Financial, said the broking business was still under some stress. “The falling volumes in secondary markets and increasing skew towards F&O (futures and options) segments put pressure on the broking business. The NSEL episode further dampened the business mood among non-institutional investors,” he said, in a post-results statement.

The National Spot Exchange Ltd, a commodities bourse, is in a Rs 5,500 crore payment crises, shaking investor confidence.

R Venkataraman, managing director at India Infoline had told Business Standard they’d be scaling down the retail broking business and focusing on more high-value clients. He said a shift towards the options segment, which resulted in lower commissions for brokers, had affected the segment. And, that the currency and commodity segments have also been affected by recent moves to introduce a transaction tax for the commodity segment and restrictions on currency derivatives.

Derivatives, which are lower-paying transactions for brokers, account for 93 per cent of overall volumes this year. Options trading is a little over three-quarter of overall volumes, depressing the earnings for brokerages.

About 450 brokers have shut shop so far this financial year.

Vinay Agrawal, executive director-equities at Angel Broking, one of the largest unlisted entities in the broking segment, said pick-up was limited in the past quarter but things might look up. “Retail participation has been limited and the revenues tend to reflect that… we expect the current rally to sustain over the next two quarters… and the outlook for broking companies is likely to be positive as a result,” he said.

)

)