Despite Petronet's good show, near-term concerns loom

Higher capacity use, margins lead to good results; static demand may make sustainability difficult

Ujjval Jauhari New Delhi Petronet LNG has seen a reversal in fortunes, with its stock price more than doubling from intra-day lows of Rs 169 in September 2015 to highs of Rs 366 on Tuesday. LNG is liquefied natural gas.

While low demand and sharp dip in spot gas prices had led to decline in its share price, the renegotiated price of imported gas, ramp-up in capacities leading to expectation of higher volumes, and better earnings (profit) have led to improved investor confidence.

In August, the company started commissioning the expansion project undertaken at its Dahej facility from 10 million tonnes per annum to 15 mtpa. The company commissioned the re-gasification facility, which may take a month or more to stabilise.

However, the additional gas dispatch from Dahej LNG terminal has started. The balance part of the expansion, that is, two LNG storage tanks, is likely to be completed by October.

This earlier-than-expected commissioning is being looked at in positive light as analysts at Emkay Global have increased volume assumption from 10.6 mt to 12 mt for FY17; this would lead to 'earnings per share' upgrade of 16.3 per cent in FY17 to Rs 15.9.

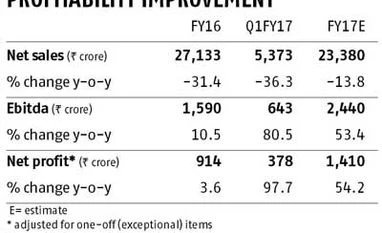

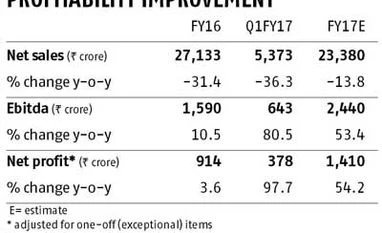

Strong June quarter performance (announced on Monday) boosted Street sentiment further. As a result, the stock touched 52-week high before closing at Rs 358 on Tuesday. The company reported a 55 per cent jump over year in net profit, which was ahead of estimates. The Bloomberg consensus estimate had pegged net profit at Rs 282 crore, but the actual figure came in 34 per cent higher at Rs 378 crore.

Better profit is being attributed to higher capacity use, strong rates, as well as trading/marketing margins. The company reported operating profit (Ebitda or earnings before interest, taxes, depreciation, and amortisation) of Rs 642 crore, up 77.9 per cent over year, which was ahead of Street estimate of Rs 501 crore.

The throughput at Dahej facility at 165 tBtu (trillion British thermal units) was ahead of analysts' estimate of 152 tBtu and implied a 131 per cent use, which is highest ever, say analysts.

Average Dahej rate was higher and analysts believe was led by marketing margins. Sachin Mehta at Centrum Broking says Ebitda jumped sharply owing to high capacity use at Dahej, positive trading/marketing margins, and non-recurrence of under-recovery of shipping charges in June quarter.

While the performance is strong and is being reflected in stock price, its sustainability in the current challenging environment holds key to earnings upgrades. Analysts at Religare Institutional Equities say Petronet LNG saw positive marketing margins (15 per cent of Ebitda margins) after three quarters of marketing losses, which is a key positive. Sustained margin expansion should lead to earnings upgrades, they add.

The challenges to the same, however, will be posed by static demand environment. Mehta points out that the blip in domestic gas output and non-availability of Dabhol LNG terminal (competing player) led to high use for Petronet LNG and this may not be sustainable on a full-year basis.

Additionally, for the expanded capacities, the company has forecast for take-or-pay revenue with GAIL, Indian Oil, Gujarat State Petronet, and Bharat Petroleum Corporation Limited, but in the initial period, customers have the flexibility to lift lower quantities, point out analysts. Thus, these factors will play a key role in future performance.

)

)