FIIs cut stake in Infosys ahead of its Q1 results

Shares of IT major gain 14% since it hit its lows post Q4 earnings in April

Chandan Kishore Kant Mumbai Foreign institutional investors (FIIs) have cut their exposure in software giant Infosys by around a percentage point, well ahead of the company's first quarter (Q1) results to be announced on Friday.

As on June 30 , FIIs’ holding in the company stood at 39.55 per cent against 40.52 per cent in the immediate previous quarter.

On the other hand, domestic institutions (DIIs) mustered courage to scale up their holdings in the company by 77 basis points (bps). One basis point is a hundredth of a percentage point.

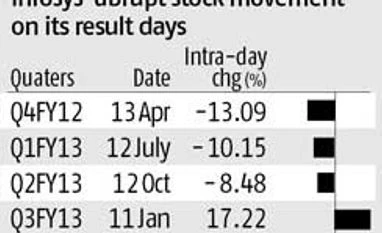

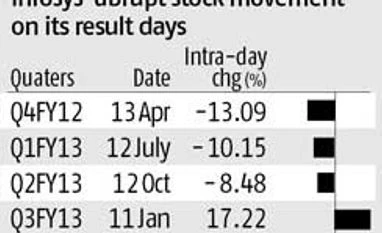

Share price movement of Infosys on its result days has been abrupt. In four of the past five such occasions, the counter had tanked steeply in the range of eight to as high as 23 per cent. Many fund managers even ended up with a wrong call on the stock and the portfolio suffered.

Infosys, in the limelight for all the wrong reasons during the quarter, reappointed co-founder Narayana Murthy as executive chairman two years after he had retired from the company.

The markets were positively surprised with Murthy's comeback and the struggling counter gained strength on the stock exchanges, though the dramatic development had also raised many eyebrows.

Ambareesh Baliga, managing partner (global wealth management) at Edelweiss Financial Services, said, “Overall, FIIs have been selling in the Indian markets. I do not think they have cut stake as a reaction to Murthy's re-appointment.”

Interestingly, FIIs had adopted the same strategy a year ago. They had cut stake in Infosys by 2.5 per cent in the corresponding quarter last year.

According to the managing director of a foreign brokerage firm, the past few quarters had been seeing a lot of actions on the counter (Infosys). “The last two quarters, in particular, have been surprising for the market participants as things unfolded beyond their expectations,” he added.

If Infosys continues to perform poorly in Q1, the share price could slip to lower levels than what we have seen in recent months, say market participants.

On Wednesday, shares of Infosys closed marginally up at Rs 2,501 on the BSE. This is 14 per cent gain since the stock touched its lows after the Q4 results in April.

)

)