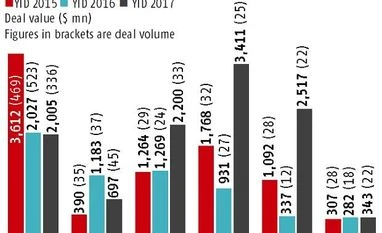

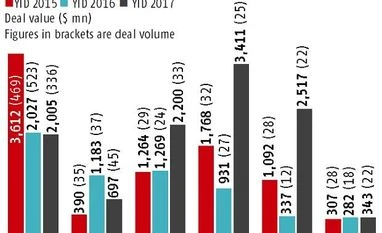

India Inc sealed Merger &Acquisition (M&) and Private Equity (PE) deals worth $48 billion in YTD 2017, up by 34 per cent over YTD 2016 and recorded a six-year high in deal values, which was primarily driven by big ticket transactions.

Notwithstanding the significant rise in the deal value, the number of transactions declined to 882 from 1,142 recorded in YTD 2016, according to Grant Thornton India LLP.

In YTD 2017, in spite of uncertainty among PE investors on the impact of GST on potential companies, the deal activity exhibited tremendous resilience with a 74 per cent growth compared to the corresponding period in the previous year, said Prashant Mehra, Partner at Grant Thornton India LLP.

As compared to the previous quarter, overall deal value for this quarter witnessed robust 36 per cent increase, while volumes declined by 29 per cent. The growth in deal value was mainly driven by big ticket PE investments. The year to date saw 32 deals valued at and over $100 million accounting for 70 per cent of total PE values.

As compared to August 2017, deal activity in September 2017 declined with over four times fall in terms of value due to the absence of billion dollar deals.

The year was dominated by e-commerce (23 per cent) and real estate (17 per cent) sectors with the two witnessing investments worth billions of dollars. On the other hand, start-up sectors continue to drive the PE volumes with over 330 investments worth $2 billion capturing 60 per cent of PE volumes.

Mehra said the highest ever private equity investments in the year stood at $15 billion. The record-breaking value figures, however, have been accompanied by a fall in terms of deal volumes by 24 per cent over levels seen in the same period last year. Despite speculation that deal activity may slowdown with fund managers taking a cautious approach towards fresh funding, value of private equity investments jumped by 74 per cent this year compared to the corresponding period in 2016.

The reason for this significant jump in value is attributed to over 30 big-ticket investments that were valued at and over $100 million compared to only 20 such deals executed in the same period last year.

Increasing efforts by the government to ease Goods and Services Tax (GST) transitioning and other ease of doing business in India initiatives, like The Code on Wages Bill 2017, is expected to boost investment sentiment, enabling companies to tap markets for fundraising, he added.

While the recent quarter concluded on a tepid note, mainly because of the effects of GST, the last quarter of 2017 is expected to end on a high note and 2018 is expected to emerge even stronger demonstrating significant growth in transaction activity.

This growth will be fuelled by the upward looking economy for domestic M&A powered by PE as well as growing inbound transactions. All this will perhaps be an outcome of the several reforms the government has initiated in the past three years and the positive effect of that now coming out end 2017-beginning 2018, said Mehra.

)

)