MCX shares soar 8% after Kotak stake buy

Stock at 40% premium to purchase price, translating into mark-to-market gains of Rs 190 cr

BS Reporter Mumbai Kotak Mahindra Bank has hit a jackpot with its 15 per cent acquisition in the country's largest commodity bourse, Multi Commodity Exchange (MCX). The private sector lender has made mark-to-market gains of nearly Rs 190 crore, or 40 per cent, on the first day itself.

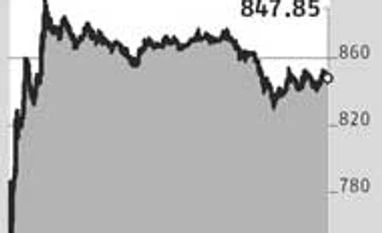

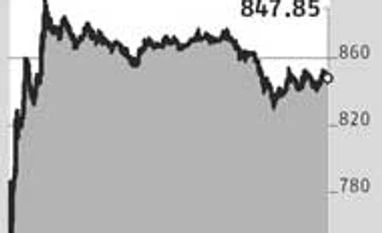

On Sunday, Kotak Mahindra Bank announced it had agreed to buy Financial Technologies India's (FTIL) 15 per cent stake in MCX for Rs 459 crore, translating into Rs 600 a share. Shares of MCX on Monday closed eight per cent higher at Rs 847.9 on the BSE.

Experts said the surge in MCX's stock price was on hopes a new investor would boost the prospects of the commodity exchange, which had seen a dip in volumes following the National Spot Exchange (NSEL) scandal last year.

"Post the overhang being resolved and FTIL's shareholding dipping to five per cent, it needs to be watched how volumes scale up on India's largest commodity exchange to an optimal level. To justify the valuation of Rs 3,000 crore, volumes need to, at least, more than double from the current Rs 19,000 crore," wrote analysts at Edelweiss in a report.

The brokerage says although the Kotak stake buy has given confidence to the bourse's operations, "improvement in operating performance will happen gradually".

"The (Kotak-MCX) deal is very good for the commodities space, which is going through challenging times. The stock went up today as the market expects a recovery in trading volumes at MCX now that a long-term good anchor investor has come on board," said P H Ravikumar, former managing director and chief executive officer National Commodities & Derivatives Exchange (NCDEX).

In December, commodity market regulator Forward Markets Commission (FMC) had directed FTIL to bring down its holding in MCX from 26 per cent to two per cent. This was after the regulator had declared FTIL unfit to operate an exchange, following the Rs 5,600-crore settlement crisis at its wholly owned spot exchange, NSEL.

Earlier this year, FTIL had appointed a committee to help divest its holding in MCX. The 15 per cent stake sale - the highest a financial institution can buy in a commodity exchange under FMC's norms - was done at a 23 per cent discount to Friday's closing price and also at a 70 per cent discount to MCX's initial public offering price of Rs 1,032, over two years ago. "As of now, we are coming in as a financial investor. We believe in the long-term franchise of MCX and we will take it along as it goes," said Paul Parambi, head-group strategy, Kotak Mahindra Bank.

Promoter lock-in norm relaxed Sebi has relaxed the three-year lock-in period for FTIL so that it can sell its MCX stake. Under Sebi norms, promoter holding of at least 20% cannot be sold for three years from the date of allotment of a public offering. MCX had come out with an IPO in March 2012. "The relaxation shall be given only to such number of shares which are to be divested by FTIL so as to reduce its stake up to 1.99 per cent of the paid-up capital of MCX as directed by FMC," Sebi said in reply to a plea by FTIL.

(Disclosure: Kotak Mahindra and Associates are significant shareholders in Business Standard Ltd)

)

)