Move over Apple, India has its own super stocks

Four stocks in the BSE 100 index have given better returns in dollar terms

Joydeep Ghosh Mumbai Investors around the world want to take a bite of Apple Inc. Besides its iconic products, the company has a market capitalisation of $743 billion, which is the highest globally.

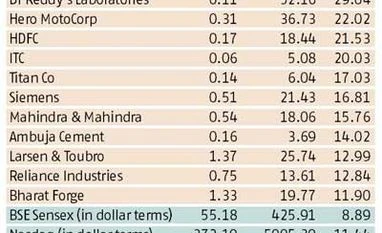

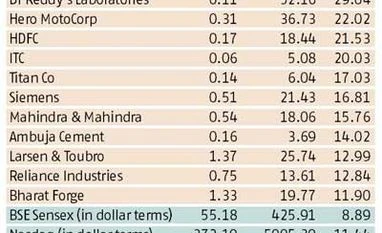

But you need not fret over not owning the Apple stock. BSE 100 stocks — HDFC, Dr Reddy’s, Hero Motorcorp and ITC — have given better returns than Apple in dollar terms (See table). For example, if an investor had bought the HDFC stock in 1991, she would be better off today. Here’s how: In 1991, HDFC’s share price was only 17 cents ($1=18.11) in dollar terms. The stock price stands at $18.44 now ($1=63.42) – in other words, a compound annual growth rate (CAGR) of 21.56 per cent. During the same period, Apple Inc’s shares rose from $1.55 in 1991 to $129.67 on April 30, 2015 – CAGR of 20.26 per cent.

This is the period when the BSE Sensex returned 8.89 per cent in dollar terms compared to Nasdaq’s 11.44 per cent.

“Many Indian bluechips have delivered better returns than Apple over the last two-and-a-half decades in dollar terms. This is interesting from the perspective that we are only a $2-trillion economy. Imagine how much value will be created as we multiply this economy over the next few decades,” says Nilesh Shah, chief executive officer, Kotak Mutual Fund.

A technical analyst says one does expect one or two outliers in emerging market who would outperform the best companies in developed markets. But four is a good number.

Globally, index funds are very popular and advocated because experts believe that they will outperform stocks or actively-managed funds over the long term. For example, John Bogle, founder and chairman of the Vanguard group has advised investors that they should only look at index funds, and not particularly actively-managed funds because the index will beat the performance over the long term. “Don't look for the needle in the haystack. Just buy the haystack!” Bogle has said.

However, it seems that the Indian market, being an emerging market, has been throwing up interesting options. Says Sunil Singhania, chief investment officer, Reliance Mutual Fund: “Stock picking is difficult in developed markets. That is the advantage of being in an emerging market because you can invest in new sectors. All these four companies were a part of the new sectors in the nineties.”

According to him, there are mutual fund schemes like Reliance Growth Fund which has given 26 per cent returns annually in the past 20 years, much higher than the Sensex’s annualised returns of 11 per cent. There are other schemes from HDFC Mutual Fund and Franklin Templeton Mutual Fund which have given similar returns for over 20 years.

Says investment analyst Arun Kejriwal: “There are quite a few hidden gems that have delivered consistently for shareholders. And it is only when you value the companies currently that they look expensive. Unlike developed markets, Indian equity culture is less than 30 years old and there is bound to be Indian-grown companies that will deliver better returns than their global counterparts.”

)

)