Niche play, alliances key for Biocon

Biosimilar opportunity in regulated markets will play out in medium run; biopharma, branded products will drive growth in short run

Ram Prasad Sahu The Biocon stock has been touching new 52-week highs in the recent past and has gained 12 per cent over the last month on the back of new launches, good June quarter performance and prospects going ahead. The company, which is in the biopharmaceuticals segment, recently launched a novel drug called ALZUMAb (to treat psoriasis), in India. While over 12 million in India are afflicted by this chronic skin condition, the market for the drug is small given the cost of treatment, the full course for which is upwards of Rs 3 lakh. The worldwide market for the same is estimated at $4.5 billion and is expected to move up to $8 billion by 2016. The company plans to file investigational new drug application with the US Food and Drug Administration (USFDA) and is looking out for partners to launch this product in the US. On the whole, Biocon has five drugs in the novel drug pipeline. While the company has already launched psoriasis drug a couple of weeks ago, its oral insulin product IN-105 in collaboration with Bristol Myers Squibb is in phase-II of the clinical trials.

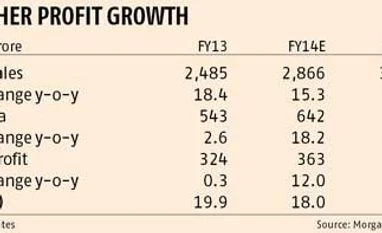

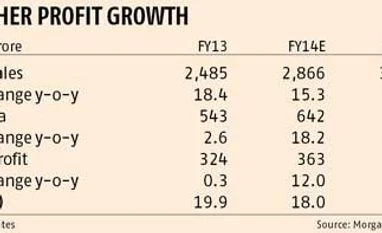

In addition to the monetisation of the novel drugs such as ALZUMAb, the key triggers for the stock, according to Citi Research, are progress on filing/approval for rh-insulin in the US and European markets, progress on biosimilar pathways and new active pharmaceutical ingredient (API) launches by partners in developed markets. If the company is able to see some traction in these areas, it would be able to achieve its sales target of $1 billion by FY18. The company had a turnover of $440 million in FY13. Analysts at Morgan Stanley have an overweight rating on the company due to improved base business fundamentals leading to mid-teens growth, progress in the global bio-similar platform and inexpensive valuation. At current price of Rs 346, the stock is trading at 17.9 times its FY14 earnings estimates. Most analysts have a target of Rs 400-425 for the stock.

Biosimilar opportunities Within biopharmaceuticals, the two key product areas for the company are insulin and monoclonal antibodies. To tap the global opportunity in these two categories, the company has a tie-up with Mylan for co-development and commercialisation, which in addition to cost sharing, and supplies will involve an upfront payment and profit-sharing. Most of these drugs are under patent which is likely to expire between 2014-2017 in the US and the EU.

In the insulin (diabetes) portfolio, while the company has registered rh-insulin in more than 45 countries, glargine insulin is registered in over 10 countries. Innovator sales for these two drugs are pegged at $10 billion, which is slightly over half of the worldwide insulin market of $19 billion. On the monoclonal antibody front, the company is in phase-III trial for the cancer drug Trastuzumab, which has a market size of $6 billion. The company is looking at expanding its presence in emerging market countries first before taking them to the regulated markets by 2015. To meet the demand from emerging markets, the company is setting up a plant in Malaysia, the first phase of which is expected to be completed by 2014.

Near-term triggers

While the biosimilar opportunities in the developed markets have immense potential, in the near-term, growth will be driven by its existing biopharma portfolio, branded formulations and research business. Biopharma segment, the largest for the company accounting for 61 per cent of sales, saw a 21 per cent year-on-year growth to Rs 439 crore in the June quarter on the back of higher sales of antibiotic fidaxomicin, weight-loss drug Orlistat and higher generic insulin sales. Dolat Capital analysts believe that a ramp-up in sales of fidaxomicin antibiotic to Canada-based Optimer will add to the sales growth for the company.

The company’s branded formulation segment, which constitutes 14.5 per cent of its overall revenues, saw a year-on-year growth of 17 per cent in the June quarter. While there are challenges due to the introduction of a new pricing regime, analysts at SKP Securities expect the segment to achieve an annual growth rate of 17.8 per cent over FY13 on the back of sustainable momentum in oncology, diabetology and nephrology and support by new divisions of comprehensive care and bio products.

)

)