Nifty below 8,000 will signal bull market reversal

Devangshu DattaThe market has moved lower for five sessions in succession. The response to the Reserve Bank of India (RBI)'s policy statement on June 2 was bearish and there have been net losses ever since. Despite the central bank delivering the expected 25 basis point cut in the repurchase rate, RBI governor Raghuram Rajan ruled out further cuts for a while. There was money riding on hopes of a bigger cut. In addition, there are fears that the US Federal Reserve will soon increase rates. The Greek situation is also unstable.

The Nifty has dropped to 8,044 from 8,433 on June 1. That is roughly five per cent correction. It is now significantly below its own 200-day moving averages (DMAs). Foreign Institutional Investors have been net sellers through May and June. Domestic institutions have stepped up buying. Local operators have also been selling.

The critical support is at the 8,000-mark. The intra-day low for 2015 is 7,997 and if that's breached, the index will register lower lows. Breadth is poor, with Declines outnumbering Advances considerably and many stocks hitting 52-week lows. A dip below Nifty 8,000 would suggest the big bull market is either in reversal or has actually reversed trend.

The previous rally started from a low of 7,997 (May 7). The uptrend fizzled between 8,450 and 8,500, with a high of 8,489 (May 22). An uptrend would have had to push past 8,850 (the peak of April 15 was 8,844) to generate a pattern of higher highs. That has obviously not happened. So, at the least, there is an intermediate downtrend in force.

On the downside, if the Nifty falls significantly below 7,997, setting a downside target would be difficult. But the big bull market would be considered to have ended, until and unless there was a pullback above the 200-DMAs.

There are few positive news triggers. However, bad news such as poor fourth quarter results have been discounted. If the Fed delays its hike and Greece resolves positively, the market could respond with a strong rally.

The movements of the financial index, the Bank Nifty, is always exaggerated in comparison to the Nifty. The Bank Nifty has dropped below 17,500 and it is below its own 200-DMAs. A bearspread of long 17,000p (200), short 16,500p (88) costs 112 and could pay a maximum of 388. Other financials have moved down with the Bank Nifty. The US dollar has hardened and it could harden further. The information technology (IT) sector might, therefore, provide some sort of hedge, since IT stocks usually move up when the rupee moves down.

The Nifty's put-call ratios (PCR) are bearish. The June PCR is down to 0.87, while the three-month PCR is at 0.96. The June Call chain has open interest (OI) peaking at 8,500c, with another OI peaking at 9,000c. The June Put OI has OI peaking at 8,000p with ample OI down to 7,700p and reasonable OI down to 7,500p.

There's plenty of time in the settlement. If the downtrend continues, a drop till 7,700 could happen in the next five sessions. A bounce till 8,500 is also possible if the trend reverses.

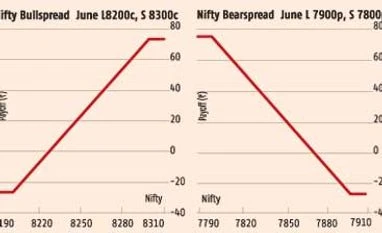

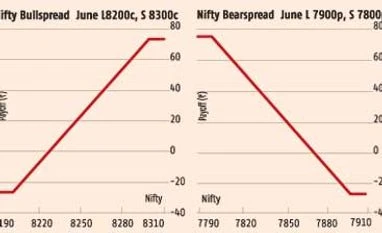

A bullspread of long June 8,200c (65), short 8,300c (38) costs 27 and pays a maximum 73, with the strike at 155 points from money. A bearspread of long 7,900p (76), short 7,800p (49) also costs 27 and pays 73 at 145 points from money. So the bearspread has a slightly better risk:return ratio. A combination of long 8,200c,7,900p, short 8,300c, short 7,800p, has an adverse ratio with a cost of 53, break-evens at 7,847, 8,253 and a maximum return of 47.

)

)