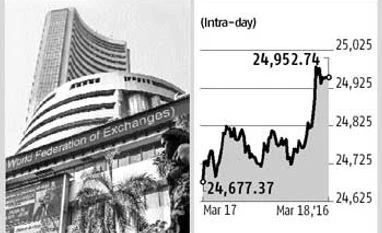

Sensex completes longest run of weekly gains this year

Bloomberg Mumbai Stocks advanced to a 10-week high, with the benchmark gauge capping a third week of gain, as risk appetite returned to developing markets after global central banks indicated a willingness to continue measures to support growth and stabilise markets.

Tata Consultancy Services, the largest software exporter, surged to its highest price this year. Bharat Heavy Electricals, India's biggest power-equipment maker, rose for a fifth day to become the best performer on the S&P BSE Sensex this week. The stretch of gains was the longest since July. GAIL India climbed to a six-week high.

Read more from our special coverage on "SENSEX"

The Sensex surged 1.1 per cent to 24,952.74, its highest close since January 6. The gauge rose one per cent this week. Emerging-market stocks were on the cusp of a bull market as crude topped $40 a barrel and the Federal Reserve's dovish stance revived demand for riskier assets. Global funds bought $1.9 billion of local shares since March 1, the biggest inflow in 15 months.

"Foreign inflows into India have become even more correlated with those going to other large emerging-market nations and that's why you need to look outside for cues," Sanjay Mookim, an equity strategist at Bank of America Merrill Lynch, said in an interview with Bloomberg TV India. "We have seen a decent pick up in flows in this EM rally and after the annual budget. Hopefully, that will continue for a while."

Indian stocks have climbed in all but three days this month after Finance Minister Arun Jaitley in his February 29 budget pledged to further cut the fiscal deficit, stoking speculation of a interest-rate cut by the central bank in its April 5 policy meeting. Reserve Bank of India Governor Raghuram Rajan said over the weekend the central bank was "comforted" by the government's plan to shrink the budget deficit to 3.5 per cent of GDP, while telling reporters to "wait and see" how that feeds into monetary policy.

The Sensex has rallied 8.5 per cent in February, poised for its best monthly performance since October 2013. Global funds bought $140 million of shares on Thursday, taking the week's inflow to $428 million.

"Our market is driven by liquidity, apart from our own fundamental strength," Pankaj Razdan, chief executive officer of Birla Sun Life Insurance, said in an interview with Bloomberg TV India. "The market is very attractive for the next three to five years. You may see volatility, but money is always made in volatile markets."

)

)