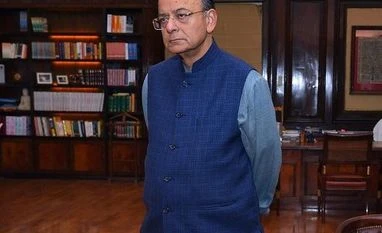

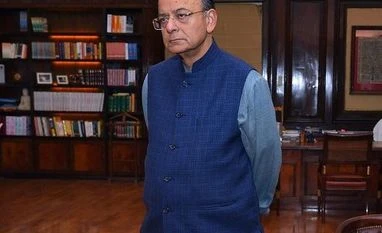

UPA govt's decision to tax Vodafone retrospectively was erroneous: Jaitley

Vodafone is facing tax claims and interest totalling more than Rs 220 billion in India

)

Explore Business Standard

Vodafone is facing tax claims and interest totalling more than Rs 220 billion in India

)

The decision taken by the previous UPA government to tax British telecom multinational Vodafone Group retrospectively was an "erroneous" one, the likes of which the ruling NDA would be loath to repeat, Finance Minister Arun Jaitley said on Saturday.

He was responding to a question from the audience on the issue at the ET Global Business Summit.

"I always felt Vodafone tax decision was an erroneous decision. This government decided it will not be taking any retrospective decision," Jaitley said.

It was precisely for this reason that the Long Term Capital Gains Tax reintroduced in the Budget earlier this month had been exempted for investments made up to January 31, 2018, he added.

The Budget 2018-19 has proposed to tax long-term capital gains on equities exceeding Rs 100,000 at 10 per cent, which is expected to bring in revenue of Rs 200 billion.

However, capital gains made on shares until January 31, 2018, will be "grandfathered", Jaitley said while presenting the budget, adding "we have protected all investments coming in before February 1".

Vodafone is facing tax claims and interest totalling more than Rs 220 billion in India, which includes Rs 142 billion for acquiring Hutchison's stake in 2007.

The UPA government had said that the Hutchison-Vodafone deal was liable for tax deduction at source (TDS) under the Income Tax (IT) Act. While the Supreme Court subsequently quashed the demand in January 2012, the government amended the IT Act retrospectively, putting the liability back on Vodafone Group.

The company last year said an international arbitration tribunal would begin trial on Vodafone's challenge to India's retrospective legislation to seek Rs 221 billion in taxes.

In this connection, the UK India Business Council (UKIBC) has said thatb predictability and clarity regarding retrospective taxation would help British companies to invest more in India.

"I think that if there was more clarity, certainty, predictability around retrospective taxation and (resolving) the Vodafone issue that would help the UK companies make their investment decisions in India," UKIBC Managing Director Richard McCallum told IANS over a telephonic interaction on Friday.

First Published: Feb 24 2018 | 9:43 PM IST