Market confronts reality, trims earnings estimates

Single-digit earnings growth raises the risk of multiple de-rating for India

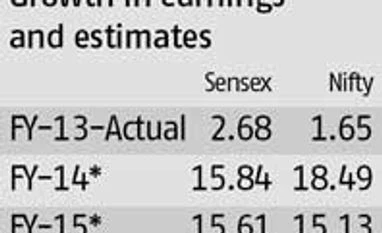

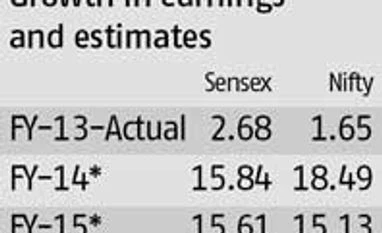

Malini Bhupta Mumbai At the start of the new financial year, the markets believed that Finance Minister P Chidambaram would kickstart growth with his magic wand, so to speak. Equity analysts bought into this theory and factored in higher earnings growth for FY14 and FY15, despite the fact that the Sensex ended FY13 with an earnings growth of three per cent. Markets estimated higher earnings growth on the back of higher better GDP growth forecasts made by the government and the central bank.

According to consensus estimates, Nifty companies are estimated to report an earnings growth of 15 per cent in FY14 and 16.5 per cent in FY15. If anything, this may be called 'irrational exuberance' because the first quarter has seen a year-on-year fall in earnings. Less than six months into the new fiscal, the market is realising that steep earnings estimates need to be trimmed to more sensible levels. Ridham Desai and Sheela Rathi of Morgan Stanley have cut their Sensex earnings growth estimates from 10.5 per cent to 4.1 per cent for FY14 and from 19 per cent to 12.7 per cent for FY15. Based on these new earnings estimates, the brokerage has arrived at its 12-month forward Sensex target of 18,200. What this essentially means is that the markets will go nowhere for the next 12 months.

In a bid to fight a new crisis every month, policy makers have forgotten that what matters in the end is growth. Till growth returns, financial markets will continue to roil. With interest rates moving up in the US and growth picking up, India has lost its TINA (there is no alternative) factor. Dhananjay Sinha of Emkay Global says that historically, portfolio flows into emerging and developing markets are inversely correlated with change in the US rate cycle. With earnings and GDP growth decelerating in emerging markets, foreign investors may not pump in the disproportionately high amounts of money into emerging markets such as India as they did between 2007 and 2008.

Earnings downgrades by themselves are not a bad thing. However, persistent downgrades pose the risk of a downgrade in India's multiple. India's superior growth meant that Indian equities commanded a premium to other emerging markets. Now with earnings slowing to single-digit levels, the market's premium valuation is at risk and if that falls, then broader indices would correct even further. Emkay's Sinha believes continued contractions in earnings estimate will likely compress multiples further. Mahesh Nandurkar of CLSA along with Rajeev Malik writes that outflows-driven PE de-rating is a bigger risk than earnings downgrade. Both the government and central bank need to bring growth back on track, as liquidity is surely not going to fuel markets any more.

)

)