The Street was enthused by GMR Infrastructure announcing gross debt reduction by almost half from Rs 37,480 crore to Rs 19,856 crore at the end of FY17. The stock gained more than 25 per cent intra-day, before closing at Rs 17, up 13.71 per cent, on Friday.

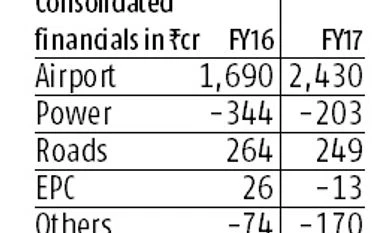

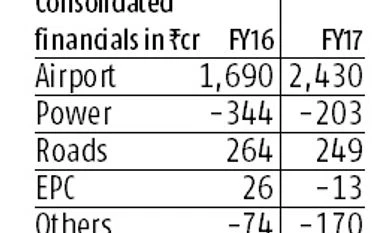

Given that there was pressure on profitability on many of the segments especially in the energy, engineering, procurement and construction (EPC) and road verticals, higher debt, and therefore increased interest outgo, was pulling down its financial performance. In FY17, for example, on an operating profit of Rs 3,497 crore, the company paid an interest of Rs 3,911 crore. This number is expected to come down going ahead.

Divyata Dalal at Systematix Shares, says reduction in debt is the key for players in the infrastructure space and restructuring should help GMR too. The reduced debt will not only help reduce interest costs, it will also lead to rating upgrades. India Ratings has already upgraded GMR Hyderabad airport’s credit ratings a few days ago. Improved ratings help the company lower cost of funding and a company’s ability to participate in new project tenders also increases. Thus GMR can benefit from this.

The company saw some uptick in segmental performance too. The airport division, contributing 60 per cent to gross revenues, saw segmental profits grow 44 per cent in FY17. GMR has added one green field airport at Goa to its portfolio, which should aid growth. It also received Rs 1,800 crore on account of termination of the Maldives airport project, which, in turn, has been utilised for debt reduction.

The power segment contributing about a fourth to gross revenues remains the next important pillar for growth. The company has resolved stressed energy assets worth Rs 12,600 crore. The Rajahmundry project in Andhra Pradesh and Chhattisgarh power project under strategic debt restructuring saw loans worth Rs 4,406 crore converted into equity This has helped as these projects are no longer under subsidiaries and remaining debt now is not considered as part of their books, say analysts.

For the EPC segment, GMR has got new awards for construction of the 221-km eastern dedicated freight corridor railway project worth Rs 2,281 crore. With the award, the company’s EPC order book is Rs 7,100 crore. The growth of the EPC order book is a positive sign for the company, looking at better funding and profitability options.

However, the EPC segment during FY17 posted losses at the operating level and was expected to rebound, while power segment operating level losses have reduced due to hiving off of subsidiaries, say analysts. Thus, while the forward estimates factor in strong airport segment growth, the profitability growth in other segments will be key for major earnings upgrades. For now, earnings will get some uptick to the extent of reduction in debt.

)

)