Some steps for falling freight traffic in Rail Budget 2016

Four measures have been announced, which include expanding of the items, rationalising of rates, signing of long-term contracts and building terminal capacity

BS Reporter New Delhi With the Railways worried about a continuous decline in its freight traffic, four measures have been announced. These are expanding the basket of items carried, rationalising of rates, signing of long-term contracts and building terminal capacity.

Currently, their freight basket is dominated by 10 commodities — coal, cement, urea and so on — which have an 88 per cent share. “We need to look beyond these to expand our revenue base. A full-fledged market study is being undertaken…to recapture that traffic through either containerisation or new delivery models — roll-on, roll-off,” said Suresh Prabhu, the minister.

They expect to increase freight traffic by only 12 million tonnes (mt) in 2015-16. In 2014-15, the Railways transported 1,095 mt of goods across India, likely to increase to only 1,107 mt in 2015-16. “The (expected) incremental traffic is 50 mt, anticipating healthier growth in the core sector,” said the minister. Therefore, for 2016-17, the target is 1,157 mt.

“The modal share of Railways (in transportation) has been declining over a long period. This has had a negative impact not only on the Railways but the entire economy,” the minister added. The government says rail’s share in transport traffic had fallen from 62 per cent in 1980 to 36 per cent in 2012.

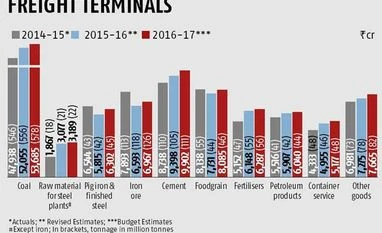

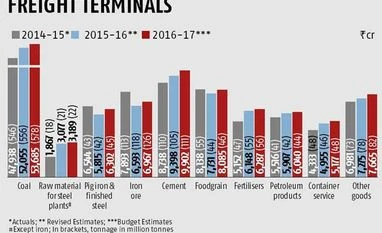

In 2015-16, the freight traffic for four major sectors — pig iron and finished steel, cement, foodgrain and container services — is expected to significantly decline. Additionally, traffic in coal and iron ore is likely to see only a marginal increase, of 9.82 mt and 5.04 mt, respectively. According to government sources, the fall in foodgrain freight traffic is especially due to Punjab’s local procurement for own storage and use.

Understanding that the current rate structure has led to out-pricing of its services in the freight market, a review will be undertaken to evolve a competitive set in comparison with other modes of transport. Such a review is expected to permit multi-point loading and unloading and to apply differentiated rates.

“From industry’s perspective, we welcome the announcement of a review of freight tariff (rate) policy to evolve a competitive freight structure and increase the share of Railways. This will help in bringing down overall logistics cost for the industry and improve our competitiveness,” said Sajjan Jindal, chairman, JSW Group.

With low demand from the core sector, the Railways have set a lower target for freight traffic at Rs 1,11,853 crore for 2015-16. The original target was Rs 1,21,423 crore. For 2016-17, they expect revenue of Rs 1,17,932 crore from freight.

In the coming year, the Railways would also explore the possibility of signing long-term rate contracts with key freight customers, using predetermined price escalation principles.

Prabhu also acknowledged that network capacity limitations do not allow the plying of freight trains on a timetable but, still, they’d start time-tabled freight container, parcel and special commodity trains on an experimental basis, he added.

On inadequate warehousing, he said they’d be creating railside logistics parks and warehousing, under public-private partnership. “The container sector would be opened to all traffic, barring coal and specified mineral ores, and part-loads would be permitted during the non-peak season. All existing terminals /sheds would be granted access to container traffic, where considered feasible,” said Prabhu. The government will also appoint key customer managers to liaison with major freight stakeholders.

“They would serve as a single point of contact for all communication and redressal with these key customers. Each zonal railway will develop a customer commitment charter, indicating service level commitments of Indian Railways to passengers and freight customers,” said the minister.

“We welcome the announcement made on expanding the freight basket of railways, wherein it is proposed to start a time-tabled freight container, parcel and special commodity trains…the manufacturing sector will also benefit from rationalising the tariff structure,” said Ajay Kapur, managing director, Ambuja Cement.

)

)