Defence manufacturing has been a priority sector for the government in the last three years. Due to the continued policy reform in industrial licensing regime, the FDI Policy and labour laws, there were no specific expectations from the union budget 2017 -2018. The expectations in the form of exemptions, concessions etc to incentivise defence manufacturing were muted considering the proposed implementation of GST later in the year.

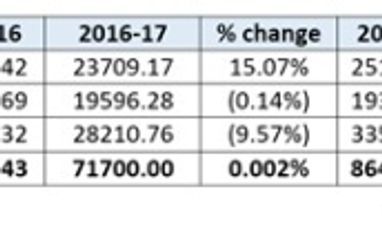

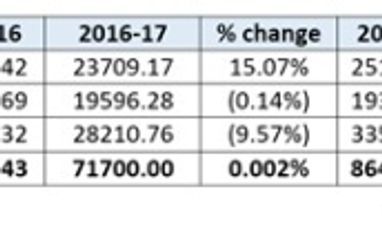

Therefore, the most relevant purpose of the budget for the sector was to track the expenditure allocated to the forces to assess what it may indicate over the course of the financial year. The budget allocations for capital acquisitions by the services suggests significant action on this front. Table 1 provides a brief overview of the budget allocations for defence.

Table clearly shows that the FY16 and FY17 were years of consolidation while the government focused on policy reform and simplification of procedures to do business in India. However, a projected hike of 20.62 percent in the overall capital outlay clearly shows that the government expects FY18 to be a year where several large acquisitions are expected to be initiated.

The absolute increase of Rs 4500 crore and Rs 5300 crore in budget allocations for the Army and the Air Force between FY16 and FY18 and the contrasting static allocations for the Indian Navy provides significant insight into the state of affairs of the services. The Indian Navy is in the midst of acquisition programs initiated between 2008-2012 and the development of these projects, though behind schedule, are progressing in a stable manner with regular commissioning of large platforms. This is reflected in the uniform budgetary allocations for the Navy over the last three fiscals.

The trends in past budgetary allocations and utilisation indicates that the government has taken a restrained view of military spending to maximise efficiency in resource utilisation. Therefore, a hike in allocations should be viewed as a strong sign of intent from the government to put money on the table and finalise large acquisitions. Coupled with the government’s stated objective to ensure indigenisation of a major part of global acquisitions, the domestic industry is poised to benefit significantly.

With the increased allocations and expected movement on acquisition of large platforms, the government also has an opportunity to flag off its innovative Strategic Partner model, which has not seen any developments since the introduction of the revised Defence Procurement Procedure in 2016. It is expected that the long-pending initiation of the Strategic Partner model will allow the domestic industry to mobilise resources in a planned manner and hit the ground running when large acquisitions are finalised.

Another positive development in the budget has been the dismantling of the Foreign Investment Promotion Board (FIPB). As a gatekeeper of foreign investment into India, the dismantling of FIPB would reduce bureaucratic delays in clearing proposals which would hasten acquisition of technology by the domestic industry. With its elimination, it will be interesting to see the manner in which, the government chooses to regulate foreign investments and whether the alternative will result in any meaningful improvement in ease of doing business in India.

_____________________________________________________________________________________________

Kabir Bogra is the associate partner at Khaitan & Co

Tushaar Talwar is the associate at Khaitan & Co

)

)