Spending rate outpaces credit card issuance growth in 2014

Spending growth tops 27 per cent in October, the highest in three years

Nupur Anand Mumbai For banks, 2014 might have been one of the worst years in terms of loan growth. However, things are different in credit cards. The growth in credit spends is at a three-year high, according to latest data from the Reserve Bank of India (RBI).

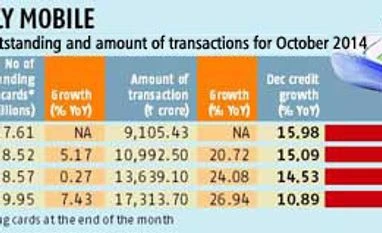

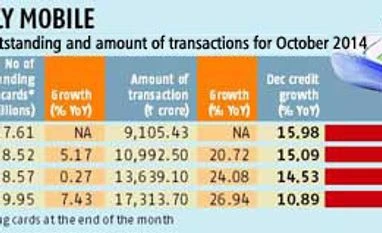

While the growth in the total number of credit cards in the system at end-October was 7.5 per cent compared to 0.3 per cent in the previous year, spends logged a robust growth of 27 per cent — from Rs 13,639 crore to Rs 17,314 crore. Overall loan growth of the banking system was 10.9 per cent till December 12, according to RBI data.

The number of cards at the end of October was 19.9 million, up from 18.5 million in the year-ago period. In 2013, while loan growth was 14.5 per cent, card spend grew 24 per cent.

A number of factors, including improved reward and loyalty points, better offers and the boom in e-tailing have pushed credit card spends. So, banks are unfazed by the single-digit growth in the number of cards in the system.

“The number of cards is growing at a slower pace than we would like, but the spends have increased. The credit card spends for the entire year has been in high double digits. And we have been focusing on growing that by giving out better offers in order to improve customer experience of shopping via cards,” said Sumit Bali, executive vice-president (personal assets) at Kotak Mahindra Bank.

Even during the festival season, lenders had tailor made several offers on credit cards to encourage consumers to use plastic money.

HDFC Bank continues to be the largest issuer of credit cards. At the end of October, the lender had a credit card base of 5.57 million, followed by ICICI Bank that has the second largest credit card base with 3.30 million card users.

Bankers believe that with the use of credit information bureau, they can extend credit cards to consumers with more confidence. “This time is different from 2008; now all banks access the credit score before giving a credit card and therefore, they lend it only to consumers with a good credit history. This has ensured that defaults have come down and lenders are also more confident about the credit card business.”

Banks have so far been restricting themselves to issuing credit cards only to consumers with whom they have a banking relationship. However, there are some lenders such as RBL Bank (formerly known as Ratnakar Bank) that have from this year onwards started offering cards to new consumers.

According to experts, convenience and better offers on credit cards will push the usage of plastic money even further.

CLARIFICATION

The graphic suggested that the spends were till October 2014, which was a mistake. Also the data for growth in spends was interchanged. Both mistakes have been corrected. We regret the errors.

)

)