Correction could last several more sessions

Devangshu DattaSome sort of a correction appears to have been triggered in the past couple of sessions. It remains to be seen how strong this is but it could last several more sessions. Insider selling in Infosys may have hit the headlines on Monday but there was actually selling across the board in multiple sectors.

The Nifty has fallen about 200 points from its all-time high of 8,627, and it could fall further. The Reserve Bank of India (RBI) decided not to cut rates last week. While this gelled with consensus expectations, it also led to some optimistic bulls cutting long positions and that has started some sort of correction in the BankNifty.

Then, the selling in Infosys triggered off selling across the information technology (IT) sector. Weaker trade data from China has also meant some sort of correction, with metals being sold down, among other commodities.

Once this sort of technical correction starts, it could continue till a strong support is hit. This is especially true since we are moving into the financial year-end for most foreign institutional investors (FIIs) and there is a historic pattern of profit-booking during the last fortnight of December.

The Nifty has moved very quickly from 8,150-8,200 to over 8,600 and this correction could retrace most of that 400-point zone. Short-term traders should assume support/resistance levels exist at 50-point intervals and act accordingly. On the upside, the Nifty would have to beat 8627 to confirm the correction is over.

On the global front, the dollar continues to harden against euro and yen and the rupee. There is some evidence that RBI is intervening regularly to keep the rupee in a desired band. China's equity markets are falling despite a recent rate cut due to weak trade data. Once the overhang of the Infosys selling eases off, the tech sector should be see a recovery, along with other export-driven sectors like pharma. Right now, there is some money flowing into defensives such as fast-moving consumer goods (FMCG).

Political productivity in the form of Bills passing through Parliament in the winter session would also be a potentially bullish signal for the market. Assembly election results could be a news-based triggers for rallies, or corrections, depending on the Bharatiya Janata Party's performance.

The hitherto outperforming sectors of banking and finance could be hit hard if the correction continues. The Bank Nifty is high-beta and so are Non-banking financial companies.

The Bank Nifty could slide till 17,500 or lower.; Trader should assume support/ resistance at 150-point intervals.

The Nifty's put-call ratios are in a danger zone. The three-month PCR is at 1.04 while the Dec PCR is at 0.97. Anything below 1 is bearish. The December Nifty Call chain has massive open interest peaking at 8,600c, with ample OI till 9,000c. The December Put OI peaks at 8,300 but there's another bulge in OI at 8,000p and ample OI till 7,500p.

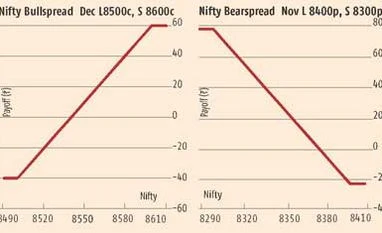

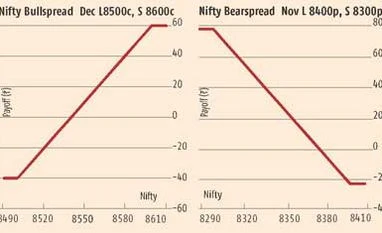

The spot Nifty closed at 8,438 with the futures at 8,475. the close-to-money spreads show that bulls are still very optimistic A bullspread of long Dec 8,500c (76) and short 8,600c (36) costs 40 and pays a maximum of 60. A bearspread of long Dec 8400p (45) and short 8,300p (22) costs 23 and has a maximum payoff of 77. The close-to-money bearspread has a better risk:reward ratio.

A trader looking for a strangle should go wider. A combination of long 8,600c, long 8,300p, short 8,700c (14), short 8,200p (11) costs a maximum 33 and pays a maximum 67 with breakevens at 8267, 8633. There are enough trading sessions left in the settlement for either end of this strangle to be hit.

)

)