Despite being active in the secondary market, a number of top global funds such as Oppenheimer, Eton Park, William Blair, Wellington, Columbia Wanger, T Rowe Price, FMR, and JPMorgan are refraining from coming in as anchor investors of Indian initial public offerings (IPOs).

Low size of the offerings and greater say of domestic mutual funds in pricing of issues is deterring their participation, say experts.

A number of these funds were active between 2009 and 2013. T Rowe Price and Eton Park, for instance, had collectively invested over Rs 500 crore in 2009 and 2010. Companies opting for a public share sale prefer marquee names as anchors as it helps build confidence among investors, including high net worth individuals. Anchor investors are institutional investors that subscribe a day before an IPO is thrown open to the public and have to adhere to a 30-day lock-in.

"While the quality of the recent offerings has been good, their size has been small. Foreign funds typically look to invest in issues that top Rs 5,000 crore," said Prithvi Haldea, founder, Prime Database.

In 2016, ICICI Prudential Life Insurance was the only firm with an offering of over Rs 5,000 crore. The issue did not see any investments from the funds mentioned above but saw significant inflows from sovereign wealth fund GIC (formerly known as Government of Singapore Investment Corporation), Morgan Stanley Mauritius and Goldman Sachs Singapore.

"IPOs in India are seen as high-risk investments by foreign investors as all information is based on the offer document. Also, the long-term track record of IPOs has not been all that great, which is why long-term offshore funds are shying away from investing," said U R Bhat, managing director, Dalton Capital Advisors (India).

Nearly half of the 135 companies that listed on the exchanges since 2009 are currently trading below their issue prices.

"The low float of the IPOs is not meeting the liquidity criteria of top US funds. There have been pricing concerns in some of the recent issues as well," said an investment banker, on condition of anonymity.

He added that a number of mid-cap funds were looking at investing in Indian IPOs. These include US-based funds such as Wasatch, Grandeur Peak, Harvard Management, and TIAA-CREF, as well as global funds of US origin like BlackRock, Capital Group, Goldman Sachs, and Fidelity that run specialist mid-cap funds.

While the anchor book was mainly driven by foreign players in the last IPO cycle of 2009 and 2010, the local funds are setting the price now, said experts.

"Domestic funds have been in a better position to assess the quality of smaller IPOs and the pricing of most recent IPOs has been done in consultation with the domestic rather than foreign funds. Domestic funds don't have constraints as far as size is concerned and are willing to invest in issues of Rs 2,000 or less," said Haldea.

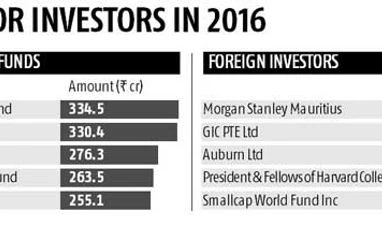

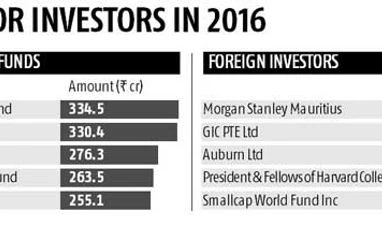

Morgan Stanley Mauritius and GIC were the top two foreign anchors in 2015 and 2016, putting in about Rs 900 crore in total. In the same period, the top two domestic anchors HDFC Mutual Fund and SBI Mutual Fund put in excess of Rs 1,000 crore in total. Besides GIC, investments from other pension and sovereign wealth firms such as Abu Dhabi Investment Authority, APG, and Nordea are seeing a rise, said experts.

In 2016, Indian anchors have invested about Rs 3,500 crore compared with Rs 3,800 crore put in by foreign anchors. In percentage terms, foreign funds contributed 52 per cent to the anchor book this year compared with 88 per cent in 2009.

"Indian mutual funds have become more confident in investing in newer themes and sectors, which until now were looked at by foreign players. Investors in IPOs of Quess Corp, Advanced Enzyme, Syngene, Thyrocare were overwhelmingly domestic," said the investment banker quoted above.

)

)