Lavasa boost for HCC

Not only will the IPO lead to better valuations, Lavasa is expected to strengthen HCC's performance

Jitendra Kumar Gupta On Tuesday, Hindustan Construction Company (HCC) announced the much-delayed initial public offering (IPO) of Lavasa Corporation, once considered a game changer for HCC. This is positive as it will help HCC partly meet its capex requirements and reduce debt. The revival of Lavasa's growth plan will also help improve HCC's consolidated profitability.

For one, Lavasa's IPO will boost HCC's valuations. Prior to the IPO announcement, analysts were valuing HCC's stake in Lavasa at Rs 8-10 a share. Based on the IPO size of Rs 750 crore, analysts expect a 15-16 per cent dilution of promoter's stake in Lavasa, which is now being valued at Rs 5,000 crore. The value of HCC's current stake of 68.7 per cent works out to Rs 45 a share. Even if one applies the holding company discount of 30 per cent, per share value of HCC's stake comes to about Rs 32.

"There is significant value that Lavasa can add. Today, the market has not recognised this value; once the listing happens, the secondary market valuations of Lavasa will have a positive impact on HCC. Also, after listing, the financial performance of Lavasa will be visible," said market expert S P Tulsian.

Of late, activity at Lavasa has picked up and several of its projects are nearing completion. On the financial front, while Lavasa's total income increased 27 per cent to Rs 171.3 crore in FY14, net loss rose 26 per cent to Rs 186 crore.

In FY14, HCC had reported a five per cent growth in stand-alone revenues to Rs 4,040 crore with operating margins expanding by 574 basis points to 15.8 per cent. The firm turned into profits after two years, posting a net profit of Rs 80.6 crore versus a loss of Rs 138 crore in FY13. There is also a marked improvement in the working capital cycle, which is down by 50 days. Recovery of earlier claims and dues have also helped in writing back some of the past expenses, leading to improvement in financials. The risk lies in slower-than-expected improvement in India's economic and investment climate, and prolonged high interest rate cycle.

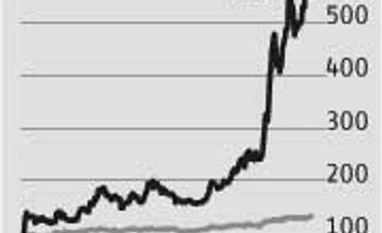

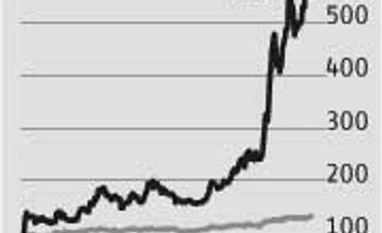

The stock, meanwhile, has run up in the recent past (up 230 per cent in four months), which possibly explains the 5.9 per cent fall after the IPO news.

)

)