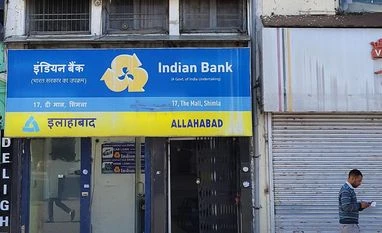

Indian Bank wholly-owned subsidiary to begin operations in FY25, says MD

The subsidiary would largely focus on back-office processing, collection, sales and marketing, Indian Bank Managing Director and CEO Shanti Lal Jain said

)

Explore Business Standard

The subsidiary would largely focus on back-office processing, collection, sales and marketing, Indian Bank Managing Director and CEO Shanti Lal Jain said

)

Public sector Indian Bank is engaged in floating a wholly-owned subsidiary with a capital infusion of Rs 10 crore and it is expected to commence operations in the next financial year, a top official said here on Thursday.

The subsidiary would largely focus on back-office processing, collection, sales and marketing, Indian Bank Managing Director and CEO Shanti Lal Jain said.

"Around a week back, we got the financial approval. It will be a wholly-owned subsidiary. We will be putting Rs 10 crore as capital and we are in the process of recruiting people at the top level like CEO, CTO...," he told reporters.

The plan to launch a subsidiary is to focus on sales and marketing, collection and recovery process, he said.

"There are many works that we are doing. Call centre work, already we are in the process of recruiting people. Maybe in the next financial year, it will be in operation. This subsidiary will not be as big as Indian Bank, they will do our work, feet on the street for collection, recovery like that," he said responding to a query.

The bank on Wednesday reported a 52 per cent jump in its net profits at Rs 2,119 crore in the October-December 2023 quarter, on the back of improvements in core income and a reduction in bad loans.

The bank earned a net profit of Rs 1,396 crore in the corresponding quarter of last year.

Observing that the digital transactions in the bank have increased to 87 per cent during the quarter under review, he said, the bank has set a target of witnessing digital transactions to the tune of Rs 75,000 crore digital transactions and as of December 2023, it stood at Rs 52,000 crore.

"We are moving towards the target (of Rs 75,000 crore) digital transactions in the current financial year...," he said. Jain said the lender has also earmarked Rs 200 crore towards upgrading cyber security over the next three years.

"For banks' internal perspective -- we have centralised servers, and have come out with new cyber system upgrading software through AI (Artificial Intelligence), ML (Machine Learning) driven," he said.

"Through AI one can identify problems, and detect the problems. This is on the cyber side we are doing," he said.

To another query, Jain said the bank continues to maintain the same projected growth of 10-12 per cent during the current financial year.

"This year we are growing by 13 per cent and we are maintaining the same projection of 10-12 per cent. The bank is well capitalized," he said.

First Published: Jan 25 2024 | 5:01 PM IST