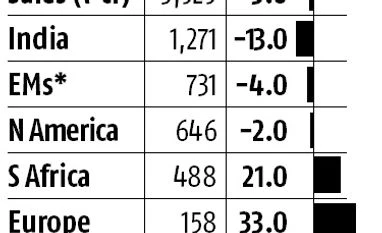

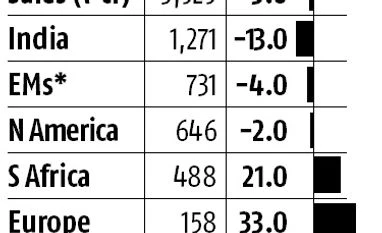

Cipla in the June quarter bore the brunt of de-stocking because of the goods and services tax (GST). Its domestic sales, the largest contributor to revenue at 40 per cent, declined 13 per cent year-on-year (y-o-y) and, as a result, revenue and profitability fell short of the consensus estimate. Net profit may have beaten expectations but it was largely due to higher other income. Revenue, at Rs 3,525 crore, fell 3 per cent y-o-y, and missed the Bloomberg estimate of Rs 3,886 crore.

There are some silver linings, however. For one, looking at the lumpiness in the past, the improvement in operating performance is worth highlighting. Although declining domestic sales had a bearing on earnings before interest, tax, depreciation, and amortisation (Ebitda) and this metric at Rs 646 crore missed the estimates of Rs 671 crore, they still grew 6 per cent y-o-y. Thus, the margins at 18.3 per cent improved 130 basis points y-o-y and 390 bps sequentially, which is positive. Cipla said profitability was driven by significant gross margin improvement and controlled spends. The higher other income of Rs 151 crore (up almost sixfold y-o-y) helped net profit grow 21 per cent y-o-y to Rs 409 crore, beating the estimates of Rs 352 crore. The margin improvement saw the stock gain over a per cent after the results but closed 1.1 per cent lower at Rs 542.70 due to the broad-based selling in markets.

Another positive is that Cipla’s domestic sales, which have been weighed down by GST-led destocking, are expected to bounce back in coming quarters. Beyond India, other geographies such as South Africa remain important for Cipla. South Africa, contributing 14 per cent to overall revenue, grew 21 per cent y-o-y and the business has maintained leadership position in key therapies.

In the US, looking at the pricing pressure and rupee appreciation, Cipla did fairly well. North American sales (slightly less than a fifth of revenue) fell by two per cent y-o-y, helped by the launch of four products. Cipla also filed three new abbreviated new drug applications (ANDAs) in the June quarter and is on track to file 25 ANDAs in FY18. The increasing approval rate for new generic launches in the US by industry players, which has led to pricing pressure for established companies as Sun Pharma, Lupin and Dr Reddy’s, however, will not have much impact on Cipla. The company has increased its focus on the US much later than its peers, and hence a higher number of approvals will help drive its US revenue. Cipla has 96 products pending approvals, and its management also said it was on target to ramp up their launch trajectory in the US.

All eyes, however, also remain on its respiratory portfolio. The company’s efforts in Europe are expected to bring benefits earlier, than the expected gains in the US. The combination inhalers’ market size in the UK alone stands at $450 million. Any fresh approvals and launches can lead to a further re-rating of the stock, which has outperformed many of its larger peers in the past one year.

)

)