IL&FS needs tie-ups to invest in new projects

IL&FS has now approached investors to raise Rs 500 cr as preference shares on a private placement basis to retire its old loans and invest in new projects

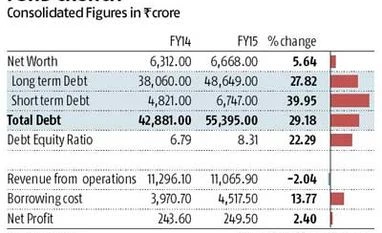

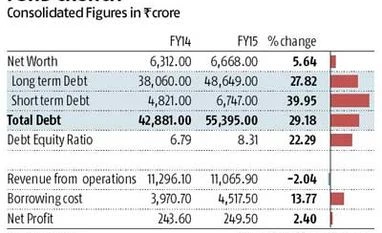

BS Reporter Mumbai Infrastructure Leasing & Financial Services (IL&FS) requires equity funding from a new partner to invest in new projects as its debt has touched a record high of Rs 55,000 crore and its existing investors want to cash out, say bankers.

IL&FS' promoters led by Life Insurance Corporation and public sector banks have declined to invest more in the company, following a government directive to disinvest in non-core assets.

IL&FS has now approached investors to raise Rs 500 crore as preference shares on a private placement basis to retire its old loans and invest in new projects, say bankers. In the last financial year, IL&FS had raised Rs 776 crore by way of a rights issue from its shareholders.

Bankers said Piramal Enterprises - which is reportedly in talks with IL&FS investors for an all-stock merger - has raised questions on the high debt of the company and how it plans to reduce it.

The increasing debt comes at a time when the revenues and profits of the company remained flat. After its exit from Vodafone at 19 per cent internal rate of return, the Piramals are looking for fresh investments opportunities and have been sounded off by IL&FS shareholders for investments.

However, the high debt of IL&FS is turning out to be a dampener and the Piramals have asked for more details on how the company will reduce its debt.

The Piramals have also asked the employees to remain invested in the company for the medium term. The employees own 12 per cent of the holding company's equity.

According to bankers, IL&FS' income mainly comes from interest, dividend received from subsidiaries such as IL&FS Financial Services, IL&FS Transportation Networks and IL&FS Investment Managers, brand fees received from group companies, and profit from divestment of its exposure in group entities.

However, due to the slowdown in the infrastructure sector in the past four years, IL&FS' income and profits remained static. "Till the economy picks up pace and IL&FS disinvests in its various subsidiaries, its income and profits are expected to remain static," said a banker.

Both IL&FS and Piramal Enterprises have declined to comment on the issue.

The Piramals want to scale up their financial services vertical and have sought shareholders approval to increase their borrowing powers to Rs 9,000 crore and make investments or provide guarantees of up to Rs 11,500 crore.

According to the consolidated numbers, IL&FS' revenue was Rs 11,065 crore, down two per cent from last year and profits was Rs 249 crore in FY15.

On a standalone basis, during FY15, IL&FS' profit after tax was Rs 305 crore on total income of Rs 1,430 crore compared to profit after tax of Rs 320 crore on total income of Rs 1,533 crore during FY14.

During FY15, IL&FS' total income included a profit of Rs 266 crore on sale of investment in a group power generating company to its energy vertical subsidiary.

The decline in profit was mainly due to a rise in interest expense and an increase in operating expenses.

)

)