LIC HF's strong show likely to continue

The company should benefit from the traction in retail demand for housing loans

Sheetal Agarwal Mumbai Healthy growth in disbursements, resilient asset quality and better than expected net profit (adjusted for one-offs) outlined LIC Housing Finance March quarter (Q4) results. However, the net profit stood at Rs 378 crore was impacted by a one-time provision towards deferred tax liability to comply with National Housing Bank (NHB) norms. Adjusting for this amount of Rs 31 crore, net profit stood at Rs 409 crore, which is 4.6 per cent ahead of the consensus Bloomberg estimate of Rs 391 crore. Not surprisingly, the LIC Housing Finance stock gained almost a per cent on a day when the S&P BSE Sensex was down nearly two per cent. Notably, analysts remain bullish on the company’s prospects and expect more gains in the counter.

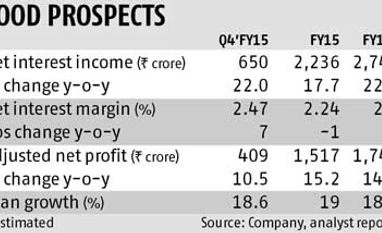

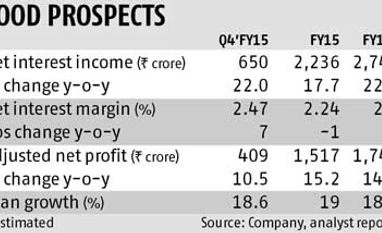

Loan growth, margins drive Q4 Healthy loan growth of 18.6 per cent, coupled with seven basis points year-on-year improvement in net interest margin (NIM) to 2.47 per cent, fuelled net interest income (NII) growth in the quarter. The NII grew 21.9 per cent to Rs 650 crore highest growth over the past four quarters (since March 2014 quarter). Notably, continued traction in individual loans (up 19.3 per cent year-on-year), considered more stable (less risky), led loan growth even as the developer loan book contracted two per cent year-on-year in the quarter.

Corporate loans form a mere 2.5 per cent of LIC HF's overall loan book. Among regions, the company is witnessing 20 per cent loan growth in the Mumbai and Delhi regions. Vijayawada, MP, Chattisgarh and the eastern region have fuelled overall growth. The management indicated in the post results call with analysts that the company was witnessing all-round growth across India. This at a time when economic conditions are weak indicate the potential.

On the other hand, NIMs (an indicator of profitability) were driven by improving product mix in favour of high margin loan against property (LAP) segment. This segment grew by over 100 per cent in the quarter and now forms about five per cent of LIC HF's overall loan book. Lower dependency on high-cost bank borrowings (from 25 per cent in FY14 to 17.5 per cent in FY15) further aided margins.

"Our borrowing costs have reduced on the back of lower bank borrowing. We can work to reduce it further. Overall, we expect some margin expansion in FY16", Sunita Sharma, MD & CEO, LIC HF said in the post results call. Increase in proportion of more profitable corporate loans can also aid margins going forward.

Importantly, the company's asset quality continued to be healthy, with gross non-performing assets (NPA) and net NPA ratios, down 20 basis points each at 0.5 per cent and 0.2 per cent, respectively, on a year-on-year business.

The road ahead

Going forward, the management remains confident on achieving healthy growth as well as maintain asset quality. Analysts, too, expect the company's loan book to grow between 15-20 per cent, compared to the 19 per cent growth in FY15, thereby driving earnings.

“We expect LIC HF to report loan CAGR of 15 per cent, spread improvement of 7 basis points in FY16 and further 15 basis points in FY17. Earning CAGR is expected to be 15 per cent over FY14-17,” write analysts at Motilal Oswal Securities in a report published post results but before the earnings call. The analysts expect the company’s return of assets to remain healthy at 1.4 per cent and return on equity at 18 per cent after dropping sharply in FY13.

Most brokerages polled by Bloomberg in April so far remain positive on the LIC HF scrip. Their average target price stands at Rs 522 indicating an upside potential of 18 per cent from current levels. At Rs 441.65, the stock trades at reasonable valuations of 2.2 times the FY16 estimated book value.

)

)