Moody's downgrades IOB's financial strength rating

Flags concern on falling asset quality, capital profile

BS Reporter Mumbai Rating agency Moody’s has downgraded Indian Overseas Bank (IOB)’s financial strength rating from “D-” to “E+”. The action reflects the bank’s weakening asset quality and capital profile.

However, the agency affirmed IOB’s senior unsecured and local currency deposit ratings at “Baa3”. It reflects the high likelihood of support that senior creditors of IOB can expect to receive from the Government of India (Baa3 stable). The government holds a 73.8 per cent stake in the Chennai-based lender.

The outlook for all these ratings is stable, Moody’s said in a statement.

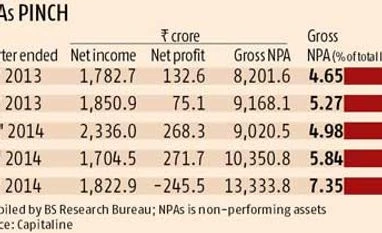

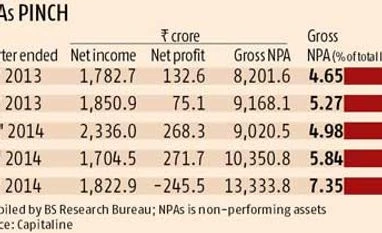

IOB reported a loss for the quarter ended September 30, 2014 owing to lower operating revenues and higher provisioning expenses.

For the September 2014 quarter, IOB reported an increase in non-performing assets (NPAs) to 7.35 per cent of gross loans from 5.84 per cent in the previous quarter (June 2014). The standard restructured loans also rose to 7.85 per cent of gross loans in September from 7.23 per cent in the previous quarter.

In addition, impaired loans — gross NPAs plus restructured loans as a percentage of gross loans — increased to 15.20 per cent, which is high for the Indian banks that Moody's rates.

The new NPAs were due to problematic corporate accounts in the iron, steel, textiles, and infrastructure sectors.

The lender’s reserves and capital provide a narrow buffer against potential losses. In the September quarter, its loan loss reserves fell to 31.7 per cent of gross NPAs from 35.8 per cent in the preceding quarter.

IOB's Tier-1 capital ratio also fell, declining moderately to 7.3 per cent from 7.4 per cent in the preceding quarter.

Moody’s expects the bank’s returns to remain weak, with falling net interest margins and elevated provisioning expenses. On the basis of assumed government support, Moody’s expects some improvement in IOB’s capital ratios through a capital infusion before March 2015. The bank has also contained loan growth, which in turn should help preserve capital.

FINANCIAL MUSCLES WEAKEN - At present, IOB is headless, without a chairman and managing director

- Bad loans rose due to problematic accounts

- Government holds 73.8 per cent stake in the bank

- It is active in gold loans in South India

)

)