After an initial appreciation shown by investors to the June quarter (Q1) results of Bharat Financial Inclusion (BFIL), which took its stock price up over two per cent on Wednesday, sanity started setting, as they realised that a second consecutive quarter of six per cent gross non-performing assets (NPAs) ratio is nothing to cheer about.

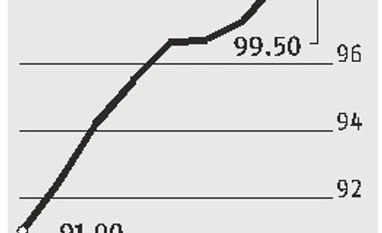

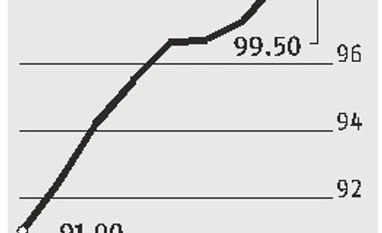

If any, it indicates that the majority of clean-up undertaken by the financier in the March quarter wasn’t adequate. Therefore, it may be premature to believe that a return of 99.5 per cent collection efficiency or a near halving in provisioning on a sequential basis, to Rs 176 crore in Q1, from Rs 335 crore in the March quarter, indicates normalcy in BFIL’s operations.

The devil lies in the details. Sample this: Member addition in Q1 has declined 47 per cent year-on-year to 416,000. Active borrowers’ number during the quarter have dipped 38 per cent to 478,000. The number of loans disbursed declined 16 per cent year-on-year to 1.89 million loan accounts; loan disbursals dipped by a per cent to Rs 3,734 crore in Q1. Barring the December 2016 quarter, which was hit by demonetisation, Q1 disbursal is the weakest in six quarters.

Going by the cautious guidance provided by larger banks such as IndusInd Bank, RBL Bank and HDFC Bank, the worst may not be over yet in terms of collection and loan disbursal for the agri and MFI sectors. Therefore, BFIL, too, could be staring at another quarter mediocre disbursals. Securitised loans, an important component for BFIL’s total loan outstanding, dipped 61 per cent year-on-year and 32 per cent sequentially to Rs 517 crore in Q1. All of this don’t augur well for the financier.

Therefore, the question is, will the financier meet the FY18 targets of 32 per cent loan disbursement growth and 50 per cent net profit growth. Going by its Q1 performance, where net interest income remained flat at Rs 213 crore and another quarter of losses at Rs 37 crore, these look tall targets.

Even then, it needs to be seen how effectively costs are brought in check. Cost-to-income ratio at 51.8 per cent in Q1 is lower than 59.3 per cent in March 2017, but yet above the 48-50 per cent seen in FY16 and FY17. Financial costs have also increased marginally to 7.5 per cent. This is despite gross yields on loans to customers increasing to 19.7 per cent in Q1, against 18.5 per cent in the March quarter. In a declining interest rate regime, where BFIL with 66 per cent exposure to term loans is enjoying low cost of funds scenario, it needs to be seen how long it shies away from passing this benefit to its customers.

For now, the only savings grace is BFIL’s better-than-required provisioning norms, which restricted the net NPA ratio at one per cent despite six per cent gross NPA ratio. But, is this alone enough to win back investor confidence?

)

)