After tepid performance in the past four years, Procter & Gamble (P&G) Home Products improved on profit in 2017-18. The largest local arm of the global home care products major, it posted Rs 3.8 billion in net profit.

This came after yearly losses since 2013-14, barring the Rs 0.2 billion in net profit for 2014-15, shows data with the registrar of companies.

Operating revenue was also back on a growth path, rising 7.4 per cent to Rs 52.1 billion. In the previous two years, revenue had fallen by 8.4 per and 12.4 per cent, respectively. In fact, despite last year’s upward movement, revenue is still lower than in 2013-14, when it was Rs 53.8 billion . A P&G spokesperson said, its last year’s performance was due to strong execution of growth strategy. “Delivering noticeably superior products, packaging, brand communications and value. Driving productivity improvement and cost savings; and strengthening organisation and culture played role in the firm’s financial performance,” the spokesperson said.

P&G is the world’s second largest fast-moving consumer goods (FMCG) entity. Its business in India is divided between three entities. P&G Home Products is the largest of these and contributes 55 per cent to total revenue. It markets baby diapers under the Pampers brand, hair care products under Pantene and Head & Shoulders, and detergents under brands Ariel and Tide. Detergents were close to half of the Rs 52.1 billion in sales during FY18.

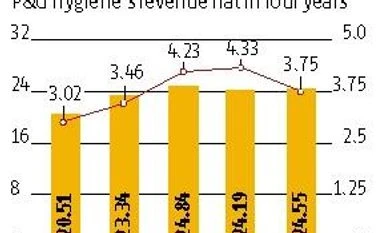

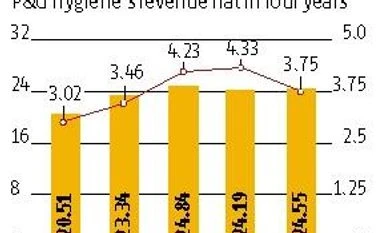

The other two entities, P&G Hygiene & Health and Gillette India, are listed on the BSE exchange, following a July to June financial calendar. P&G Hygiene & Health is now contributing close to 26 per cent to the group’s total revenue in India. It sells female hygiene items under the Whisper brand, oral care products under Oral-B and over-the-counter products under Vicks. Revenue growth has remained nearly flat for four years.

Smallest of the three, Gillette India, known for its male personal care products, also saw revenue dwindle in recent years. In 2017-18, it was Rs 16.8 billion, compared to Rs 17.5 billion in 2012-13. Net profit, however, has improved during the period. The net profit margin went up steadily to 17.8 per cent last year, compared to 2.9 per cent in 2013-14.

In fact, P&G Home’s net profit margin stood out in 2017-18, compared to the previous four years. The margin went up to 7.8 per cent. Between 2013-14 and 2016-17, it had a posted net loss thrice. In 2014-15, when it posted a profit, its margin was a dismal 0.37 per cent.

Analysts say P&G has clearly ceded ground in India, led in part by its strategy. “About three years ago, P&G globally articulated that it was keen to keep its attention on its top two markets, the US and China,” says Abneesh Roy, senior vice-president at financial services entity Edelweiss. “The result was that it de-focused its attention on markets such as India whose contribution to global turnover is in low single digit.”

P&G’s business remains much lower than global arch rival Unilever in India. Hindustan Unilever (HUL), the local arm of Unilever, is the largest non-cigarettes FMCG player in the country, with annual revenue of Rs 352 billion. P&G sales have remained at Rs 90 billion -level for five years. HUL’s revenue five years earlier was Rs 280 billion.

)

)